The Weimar and the Beagle are enjoying the new couch...

and

For some reason this is comfortable. I have no idea why. And yes, we are still moving in......three months later......

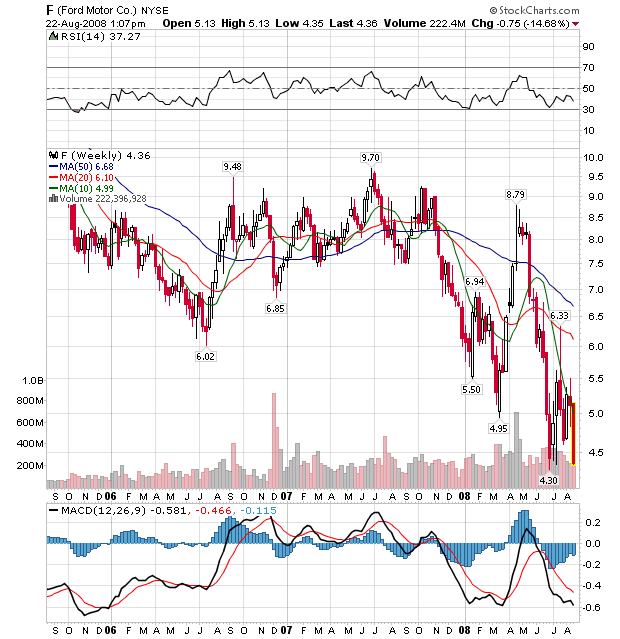

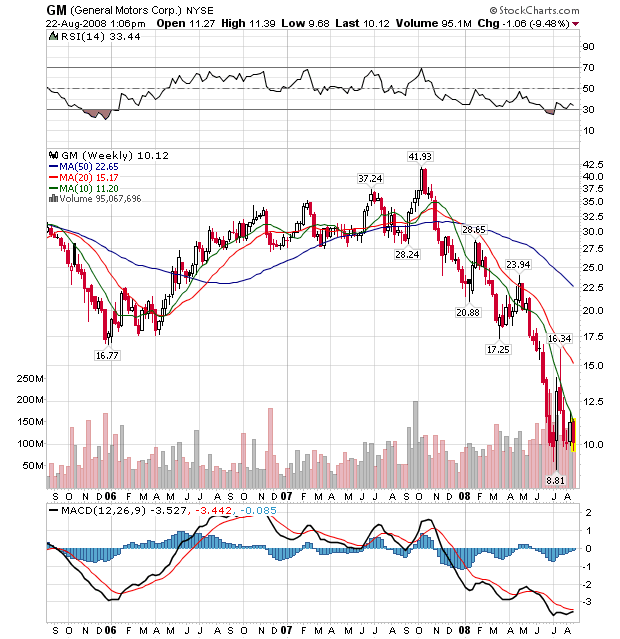

Lobbyists for the U.S. automakers—General Motors, Ford Motor and Chrysler—briefed White House officials, as well as U.S. Rep. John Dingell and other Michigan Democrats, on a possible bailout and plan to unveil the proposal after Labor Day, according to the report.

The plan is for the government to lend some $25 billion to the automakers in the first year at an interest rate of 4.5 percent, or about one-third what the companies are currently paying to borrow, the report said.

General Motors Corp., the largest U.S. automaker, reported a second-quarter loss of $15.5 billion because of strains from truck leases, costs from labor disputes and plunging U.S. sales.

......

The mounting losses are siphoning resources Chief Executive Officer Rick Wagoner, 55, needs to develop fuel-saving cars to replace the pickup trucks and sport-utility vehicles being abandoned by U.S. buyers. Wagoner, now in his 9th year as CEO, won't project when GM will restore profit as he cuts costs by an additional $9 billion annually and carries out a plan to boost cash by as much as $17 billion.

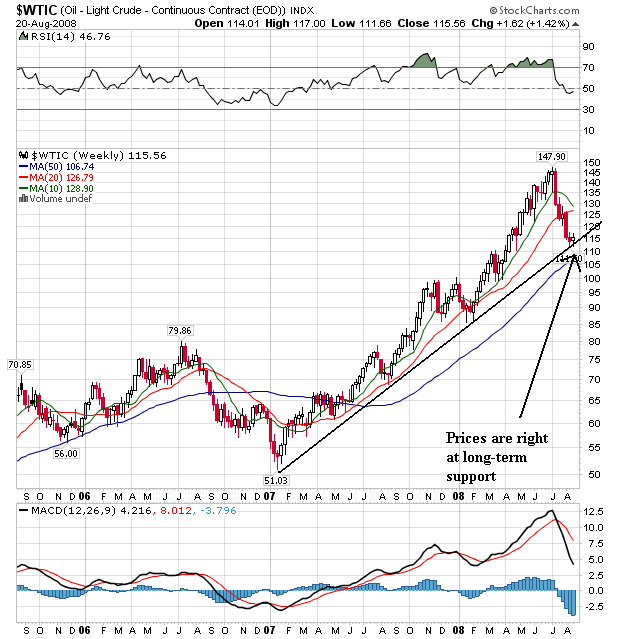

``The trends that are out of their control, those are the things that have the potential to overwhelm them,'' Robert Schulz, a debt analyst at Standard & Poor's, said yesterday. He was referring to record gasoline prices that have transformed consumer behavior while a weakened U.S. economy drains auto sales to 15-year lows. ``We don't see the macro environment anywhere near on the mend,'' Schulz said.

.....

S&P yesterday cut GM's credit rating one level to B-, or six steps below investment grade, because falling U.S. sales are causing the automaker to use more cash than anticipated. With the U.S. auto slump expected to carry into next year, GM faces a risk of further cuts, Schulz said. GM had the highest rating, AAA, from 1953 until 1981.

General Motors, Ford, Toyota and other automakers said Friday that their U.S. sales fell by double-digits. Nissan Motor Co. was the only major automaker to report a gain, with truck sales up 18 percent thanks in part to the new Rogue crossover and a boost in incentives. Nissan's overall sales rose 8.5 percent.

Automakers were expecting a slide in July as high gas prices continued to cut into sales of trucks and sport utility vehicles and new troubles in the auto leasing sector further wrecked consumers' confidence. July's seasonally adjusted sales rate -- which shows what sales would be if they continued at the same pace for the full year -- was 12.5 million vehicles, according to Autodata Corp. That's down from 17 million as recently as 2005.

Automakers expect things to get worse before they get better.

The committee places particular emphasis on two monthly measures of activity across the entire economy: (1) personal income less transfer payments, in real terms and (2) employment. In addition, we refer to two indicators with coverage primarily of manufacturing and goods: (3) industrial production and (4) the volume of sales of the manufacturing and wholesale-retail sectors adjusted for price changes.

The general business conditions index, at 2.8, increased slightly from its July level of -4.9, indicating a marginal improvement in business conditions over the month. Roughly a quarter of respondents reported that conditions improved in August, while 23 percent reported that conditions had deteriorated. The new orders index, after increasing in July, fell slightly below zero to -2.2. The shipments index, in a similar pattern, gave up its July gains, falling to -0.9. The unfilled orders index held steady at -9.0, as did the delivery time index, at -3.4. The inventories index rose sharply after a steep decline last month, rising above zero to 5.6, its highest level in over a year.

The region's manufacturing sector remains weak, according to firms polled for the August Business Outlook Survey. Indexes for general activity, new orders, shipments, and employment were all negative again this month, although slightly higher than in July. Price pressures remain but were slightly less widespread compared to recent months. However, more than one-third of the firms continue to report higher prices for their own manufactured products. Most of the survey's future indicators moved higher this month, suggesting that the region's manufacturing executives believe growth in their sector will return over the next six months.

The Labor Department's weekly tally of claims for unemployment benefits shows joblessness is at recessionary levels, while the Conference Board's index of leading indicators, released Thursday, dropped sharply last month, suggesting economic conditions will weaken further this year.

"A few months ago, there was some discussion about a second-half recovery," said Ken Goldstein, an economist with the Conference Board, a business research group based in New York. Now, "if there's a second-half recovery, it'll be the second half of 2009."

The economics of the food business are partly to blame. Though crude oil is the main ingredient of gasoline, processed foods like cereal, crackers or cookies use only a small amount of corn, wheat and other grains, limiting manufacturers' pricing power.

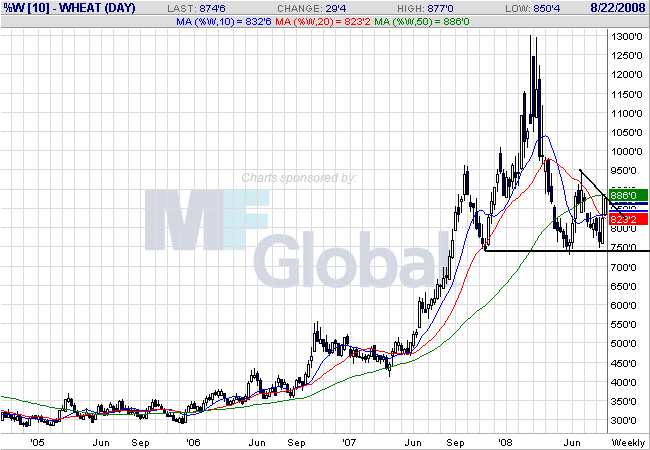

"Basically, there's only a few cents worth of corn in a box of corn flakes, so food prices are much slower to react to the downside than energy prices, " said Richard Feltes, senior vice president and director of commodity research for MF Global in Chicago.

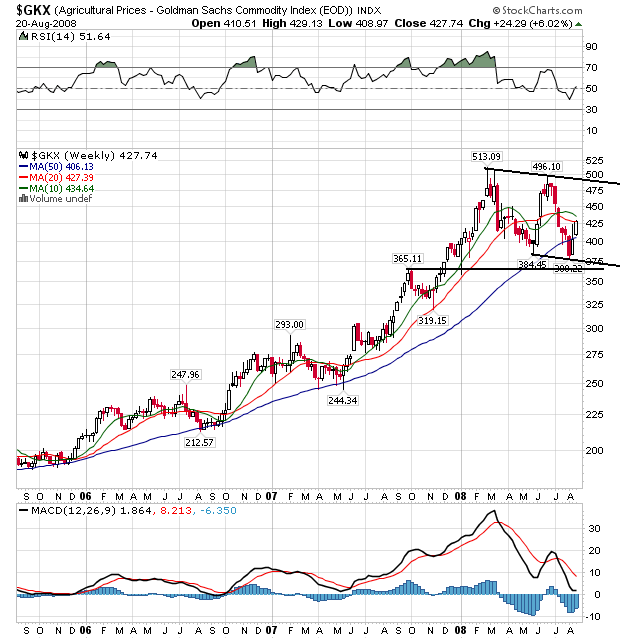

Another factor keeping food prices high: Though commodities prices have fallen from record levels, they're still well above historical levels. Corn and soybeans have dropped 24 percent and 17 percent, respectively, in the last two months but are still about double where they were two years ago.

Looking ahead to next year, economists see a mixed bag for American consumers. While falling grain prices should slow the rate of increases for baked goods, the USDA's Leibtag says people can expect to pay more for other items like beef, pork and chicken.

That's because as grain markets took off, the cost of corn- and soybean-based animal feed skyrocketed. Now, livestock owners — who spend half or more of their production costs on feeding their animals — have had to thin the size of their herds and flocks to deal with the increases. Cow slaughter has jumped 22 percent over last year, while hog slaughter is up 10 percent.

Much of that meat has gone into freezers to handle excess supply, but as the inventory dwindles, livestock owners won't have the money to replenish their herds to meet demand.

"That's going to have some serious consequence at the retail level," said Jesse Sevcik, vice president of legislative affairs at the American Meat Institute. "The only thing left is for prices to go up."

Expensive animal feed has also battered poultry producers, who so far have resisted passing on those costs to consumers to safeguard chicken's image as a good value compared to ribeye steaks and pork chops. But that's about to change, said Bill Roenigk, senior vice president of the National Chicken Council.

"From a consumer standpoint, more and more of these feed costs are going to be passed on and that means higher prices at the supermarket," said Roenigk.

Falling grain prices have taken some

Fannie Mae and Freddie Mac tumbled in New York trading to the lowest valuations since at least 1990 as speculation increased that the U.S. Treasury will bail out the mortgage-finance companies, wiping out shareholders.

Fannie, based in Washington, slumped as much as 20 percent and McLean, Virginia-based Freddie dropped as much as 32 percent, extending its losses to 90 percent for the year.

``Using taxpayer money to bail them out looks like it's becoming reality now,'' said Michael Nasto, the senior trader at U.S. Global Investors Inc., which manages $5 billion in San Antonio. ``That's going to leave the shareholders holding worthless paper.''

The worst of the global financial crisis is yet to come and a large U.S. bank will fail in the next few months as the world's biggest economy hits further troubles, former IMF chief economist Kenneth Rogoff said on Tuesday.

"The U.S. is not out of the woods. I think the financial crisis is at the halfway point, perhaps. I would even go further to say 'the worst is to come'," he told a financial conference.

"We're not just going to see mid-sized banks go under in the next few months, we're going to see a whopper, we're going to see a big one, one of the big investment banks or big banks," said Rogoff, who is an economics professor at Harvard University and was the International Monetary Fund's chief economist from 2001 to 2004.

"We have to see more consolidation in the financial sector before this is over," he said, when asked for early signs of an end to the crisis.

"Probably Fannie Mae and Freddie Mac -- despite what U.S. Treasury Secretary Hank Paulson said -- these giant mortgage guarantee agencies are not going to exist in their present form in a few years."

Confidence among U.S. homebuilders was unchanged in August at a record low, signaling there is no relief in sight from the worst housing slump in a quarter century.

The National Association of Homebuilders/Wells Fargo sentiment index held at 16 for a second month, the Washington- based group said today. Readings under 50 mean most respondents view conditions as poor.

Builders are delaying projects as sales drop, foreclosures throw more houses on the market and prices tumble. Job losses, stricter lending rules and growing buyer pessimism indicate builders will need to cut prices further to stimulate demand.

Questions on residential real estate lending. Large majorities of domestic respondents reported having tightened their lending standards on prime, nontraditional, and subprime residential mortgages over the previous three months. About 75 percent of domestic respondents—up from about 60 percent in the previous survey—indicated that they had tightened their lending standards on prime mortgages.2 Of the 32 respondents that originated nontraditional residential mortgage loans, about 85 percent—up from about 75 percent in the April survey—reported having tightened their lending standards on such loans.3 Finally, 6 of the 7 respondents that originated subprime mortgage loans—a somewhat higher proportion than in the April survey—indicated that they had tightened their lending standards on those loans over the past three months.4

It's the 5th bank [Wachovia] to agree to repurchase auction-rate securities under pressure from federal and state regulators who said the banks misled investors. It'll buy $8.5 bil worth that investors couldn't sell. Citi, (C) UBS, (UBS) JPMorgan Chase (JPM) and Morgan Stanley (MS) also have agreed to buy back the securities. N.Y. may sue Merrill Lynch over the issue and is probing Fidelity and Charles Schwab. (SCHW)

UBS agreed on August 8 to buy back $18.6 billion of debt securities, starting with $8.3 billion from retail and charitable clients beginning on October 31, and as much as $10.3 billion from institutional clients beginning in June 2010. It also agreed to pay a $150 million fine.

CITIGROUP agreed on August 7 to buy back $7.5 billion of its investors' auction rate paper at par to settle charges by the SEC and New York State Attorney General Andrew Cuomo. That would cover an estimated 40,000 retail customers. By November 5, Citigroup plans to have fully reimbursed retail investors. It also plans to try by the end of 2009 to liquidate $12 billion of debt held by more than 2,600 institutional investors. Citigroup will pay a $100 million fine.

MORGAN STANLEY settled with New York State Attorney General Mario Cuomo on August 14 and agreed to buy back $4.5 billion of auction-rate securities from individuals, charities and small- and mid-sized businesses by Dec. 11 and pay a $35 million fine. It will also reimburse customers who sold debt at a loss.

JP MORGAN CHASE settled with New York State Attorney General Mario Cuomo on August 14 and agreed to buy back $3 billion in debt by Nov. 12 and pay a $25 million fine, and reimburse customers who sold debt at a loss.

Similarly, the balance sheets of both companies have been destroyed. On a fair-value basis, in which the value of assets and liabilities is marked to immediate-liquidation value, Freddie would have had a negative net worth of $5.6 billion as of June 30, while Fannie's equity eroded to $12.5 billion from a fair value of $36 billion at the end of last year. That $12.5 billion isn't much of a cushion for a $2.8 trillion book of owned or guaranteed mortgage assets.

What's more, the fair-value figures reported by the companies may overstate the value of their assets significantly. By some calculations each company is around $50 billion in the hole. But more on that later.

.....

Note, too, that Fannie and Freddie have nonpareil lobbying operations and formidable political strength, owing to their hefty donations and penchant for hiring former political operatives. Besides, the agencies claim they've landed in their current predicament through no fault of their own. As Freddie Mac Chairman and CEO Richard Syron recently put it, the GSEs have been hit by a "100-year storm" in the housing market, accentuated by some higher-risk mortgages that they were forced to buy to meet government affordable-housing targets.

The latter contention is more than disingenuous. A substantial portion of Fannie's and Freddie's credit losses comes from $337 billion and $237 billion, respectively, of Alt-A mortgages that the agencies imprudently bought or guaranteed in recent years to boost their market share. These are mortgages for which little or no attempt was made to verify the borrowers' income or net worth. The principal balances were much higher than those of mortgages typically made to low-income borrowers. In short, Alt-A mortgages were a hallmark of real-estate speculation in the ex-urbs of Las Vegas or Los Angeles, not predatory lending to low-income folks in the inner cities.

.....

The cost of selling new preferred stock, meanwhile, would seem to be prohibitive for Fannie and Freddie. The dividend yields on their preferreds have soared to around 14%, in part because of a recent rating downgrade by Standard & Poor's. Yields that high would blight the future earnings prospects of both concerns.

Should the agencies fail to raise fresh capital, the administration is likely to mount its own recapitalization, with Treasury infusing taxpayer money into the enterprises, according to our source. The infusion would take the form of a preferred stock with such seniority, dividend preference and convertibility rights that Fannie's and Freddie's existing common shares effectively would be wiped out, and their preferred shares left bereft of dividends. Then again, the administration might show minimal kindness to preferred shareholders; local and regional bankers have been lobbying the Bushies not to wipe out the preferred since the bankers own a lot of that paper and rely on the bank preferred-stock market for much of their own equity capital.

An equity injection by the government would be tantamount to a quasi-nationalization, without having to put the agencies' liabilities on the nation's balance sheet, and thus doubling the U.S. debt. Treasury would install new management and directors at both, curb the GSEs' sometimes reckless investment and guarantee operations, and liquidate in an orderly fashion the GSEs' troubled $1.6 billion in on-balance-sheet investments. Then the companies could be resold to the public without their explicit government debt guarantees, or folded into government agencies like Ginnie Mae or the FHA.

Merrill Lynch, Wachovia and other financial companies are at risk of failure as the cost of raising capital soars at a time when the banks need to pay settlements over auction rate securities, David Kotok, chairman & chief investment officer from Cumberland Advisors, told CNBC Monday.

The cash companies need to shore up bad investments, "is up to about $50 billion and will probably top $100 billion before it's over," he added.