Here's Scoobey enjoying a view

And Sarge enjoying the wood floor

And Kate in a new "Weimar Spot"

Sales of existing homes in June slowed more than expected and hit their lowest level in 10 years, according to an industry trade group report released on Thursday.

The National Association of Realtors reported that sales by homeowners dipped in June to an annual pace of 4.86 million, down 2.6% from a pace of 4.99 million in May.

That's the lowest rate on record since the first quarter of 1998, when existing home sales fell to an annual pace of 4.83 million, according to Walter Molony, spokesman for NAR.

The existing home sales rate - including single-family, town homes, condominiums and co-ops - is down 15.5% from the 5.75 million units sold in June 2007.

.....

But with inventory still on the rise, home prices are falling further. The number of homes available for sale at the end of June rose 0.2% to 4.49 million, which represented an 11.1-month supply of inventory at the current sales pace, up from a 10.8-month supply in May.

Meanwhile, the median price of a home sold in June fell to $215,100, down 6.1% from $229,000 a year earlier.

foreclosure filings more than doubled in the second quarter from a year earlier as falling home prices left borrowers owing more on mortgages than their properties were worth.

One in every 171 households was foreclosed on, received a default notice or was warned of a pending auction. That was an increase of 121 percent from a year earlier and 14 percent from the first quarter, RealtyTrac Inc. said today in a statement. Almost 740,000 properties were in some stage of foreclosure, the most since the Irvine, California-based data company began reporting in January 2005.

``Rising foreclosures are putting downward pressure on prices, increasing the possibility that homeowners will go upside- down on their mortgages,'' said Sheryl King, chief U.S. economist at Merrill Lynch & Co. in New York. ``That will cause more losses in mortgage portfolios and less willingness from investors to securitize mortgages and therefore fewer mortgages.''

About 25 million U.S. homeowners risk owing more than the value of the their homes, according to Bill Gross, manager of the world's biggest bond fund at Pacific Investment Management Co. That would make it impossible for them to negotiate better loan terms or sell their property without contributing cash to the transaction.

The percentage of vacant homes available for sale in the U.S. continues to hover at record levels.

Census Bureau figures show 2.8 percent of homes, excluding rental properties, were empty and on the market from April through June. The vacancy rate hit a record high of 2.9 percent in the first quarter of 2008. It was 2.6 percent a year ago.

Sales of new homes in the U.S. dropped less than forecast last month as builders offered incentives to reduce a glut of unsold properties.

Purchases decreased 0.6 percent to a 530,000 pace from 533,000 in May, a reading higher than previously estimated, the Commerce Department said today in Washington. A separate report showed orders for durable goods unexpectedly rose in June.

The number of properties on the market dropped by the most in four decades, today's report showed, indicating builders are making some headway in clearing out inventories.

``We may have not touched bottom yet in the housing market, but we're clearly not in any freefall,'' Joel Naroff, president of Naroff Economic Advisors Inc. in Holland, Pennsylvania, said before the report.

Reports from the twelve Federal Reserve Districts suggest that the pace of economic activity slowed somewhat since the last report. Five eastern Districts noted a weakening or softening in their overall economies, while Chicago characterized its economy as sluggish and Kansas City noted a moderation in growth. St. Louis said activity was stable and San Francisco reported little or no growth. Cleveland and Minneapolis reported slight increases in economic activity, while Dallas described growth as steady and moderate.

Consumer spending was reported as sluggish or slowing in nearly all Districts, although tax rebate checks boosted sales for some items. Tourist activity was mixed, with residents in several Districts choosing to vacation closer to home due to high gasoline prices. The demand for services was also mixed across Districts, with strength in the IT and health care industries offsetting some weakness in other service sectors. Manufacturing activity declined in many Districts, although demand for exports remained generally high. Residential real estate markets declined or were still weak across most of the country. Commercial real estate activity also slowed or remained sluggish in a majority of Districts, although a few Districts noted slight improvement. In banking, loan growth was generally reported to be restrained, with residential real estate lending and consumer lending showing more weakness than commercial lending. Districts reporting on agricultural activity said conditions were mixed, based largely on how June precipitation affected them. Districts reporting on the energy sector said it continued to strengthen.

All reporting Districts characterized overall price pressures as elevated or increasing. Input prices continued to rise, particularly for fuel, other petroleum-based materials, metals, food, and chemicals. Retail price inflation varied across the country, with some Districts reporting increases but others noting some stability, at least for the present. Wage pressures were generally limited in most Districts, as labor market demand was soft except for highly skilled workers and in the energy sector.

Consumer spending was reported as sluggish or slowing in nearly all Districts, although tax rebate checks boosted sales for some items

The demand for services was also mixed across Districts, with strength in the IT and health care industries offsetting some weakness in other service sectors

Manufacturing activity declined in many Districts, although demand for exports remained generally high.

Residential real estate markets declined or were still weak across most of the country

Home prices across 20 major U.S. cities have dropped a record 15.3% in the past year and are now back to where they were in the summer of 2004, according to the Case-Shiller home price index released Tuesday by Standard & Poor's.

Prices in the 20 cities are now down 17.8% from the peak two years ago.

Prices were lower in April than they were a year earlier in all 20 of the major metropolitan areas as tracked by the Case-Shiller index.

Sales of existing single-family homes declined 3.2 percent to an annual rate of 4.27 million pace. Purchases of condos and coops increased 1.7 percent to a 590,000 pace.

The median sales price fell to $215,100 from $229,000 in June 2007. The median cost of a single-family home decreased 6.7 percent to $213,800, while that of condominiums and co-ops fell 2.2 percent to $224,200.

Purchases decreased in three of four regions, led by a 6.6 percent decline in the Northeast. Sales rose 1 percent in the West, which also showed a 17 percent drop in the median price, the biggest of any region.

The number of previously owned unsold homes on the market at the end of June rose to 4.49 million from 4.482 million in May. The total represented 11.1 months' supply at the current sales pace. The agents' group has said that a five-to-six month's supply reflects a balanced market.

A government rescue of Fannie Mae and Freddie Mac would require taxpayers to pay ``way'' more than the $25 billion estimated by the Congressional Budget Office, potentially as much as $1 trillion, Senator Jim Bunning said.

Treasury Secretary Henry Paulson ``hasn't told us the truth about this bill,'' Bunning, a Republican from Kentucky, said in an interview with Bloomberg Television today. ``Why would you put in a backstop of unlimited amounts of money if you weren't going to need it.''

Fannie Mae and Freddie Mac may need to record more writedowns after they expanded their purchases of non-guaranteed subprime and Alt-A mortgage securities just as other investors fled to safer investments, their regulator said.

The value of $217 billion of the so-called non-agency securities is falling as other financial firms write down their holdings, the Office of Federal Housing Enterprise Oversight said in its annual mortgage market report. Privately issued securities backed by subprime mortgages made up 9.2 percent of the companies' combined portfolio, while Alt-A represented about 5.8 percent, Ofheo said.

Five of the largest U.S. financial institutions, led by Wachovia Corp. and Washington Mutual Inc., reported combined quarterly losses of more than $11 billion. But their shares jumped an average of 14% on rising hopes that battered bank stocks have fallen about as low as they can go.

The buying frenzy, also fueled by short sellers covering bearish bets, was at odds with the mostly somber assessment by bank executives Tuesday of the shaky loans and struggling economy bedeviling the industry.

In a sign of the loan woes likely to haunt them for years, Wachovia, Washington Mutual, SunTrust Banks Inc., Fifth Third Bancorp and Regions Financial Corp. socked away nearly $13 billion in loan-loss provisions. Wachovia, Regions and Fifth Third also cut their dividends in order to conserve cash.

Financial stocks are up 31% in the past five trading days. The five big lenders that reported quarterly results Tuesday have climbed by an average of 60% over that period. Tuesday's gains increased their combined stock-market value by $11.6 billion -- almost identical to their total losses in the second quarter.

The Treasury market is abuzz with chatter about possible changes to the government's supply calendar as the bill for the credit crunch and the weak economy keeps rising.

The Treasury Department reports its next quarterly refunding schedule on July 31. Bond investors are speculating it could bring back either the three-year note, which was eliminated a year ago, or the seven-year note, which was last sold in 1993, to meet its increased funding needs. A third option is to expand the sale of 10-year notes, making it a monthly event. Currently, the department auctions a new 10-year note every quarter and reopens it one month later.

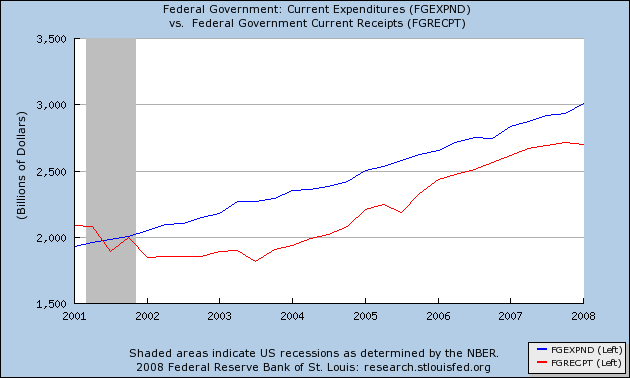

The need for change in the supply calendar has grown in the past year as the economy has slowed, resulting in lower tax receipts. This year's economic-stimulus package has added to the budget shortfall. Other items, such as support for mortgage lenders Fannie Mae and Freddie Mac, would further increase borrowing needs.

Bank examiners from the Federal Reserve and the Office of the Comptroller of the Currency are looking at the books of mortgage investors Fannie Mae and Freddie Mac, a person familiar with the situation said.

The examiners are working with the two companies' main regulator, the Office of Federal Housing Enterprise Oversight, or Ofheo, this person said. This joint effort to assess the financial condition of the two government-sponsored companies was first reported by the New York Times Web site late Monday.

Fannie and Freddie face sizable losses as defaults increase and home prices fall. That has caused a plunge in their share prices over the past few weeks, though the shares have recovered somewhat in recent days. Ofheo has said that the companies' capital remains above their regulatory minimums.

Fannie Mae and Freddie Mac may need to record more writedowns after they expanded their purchases of non-guaranteed subprime and Alt-A mortgage securities just as other investors fled to safer investments, their regulator said.

The value of $217 billion of the so-called non-agency securities is falling as other financial firms write down their holdings, the Office of Federal Housing Enterprise Oversight said in its annual mortgage market report. Privately issued securities backed by subprime mortgages made up 9.2 percent of the companies' combined portfolio, while Alt-A represented about 5.8 percent, Ofheo said.

By investing ``heavily'' in private-label securities in 2004 and 2005, the companies ``significantly increased their exposure to fair value losses from changes in market prices,'' Ofheo said. Structured investment vehicles and securities firms, battered by $452 billion in asset writedowns and credit losses, were invested in similar securities and have contributed to the price swings that may lead to more losses at Fannie Mae and Freddie Mac under generally accepted accounting principles.

``To the extent that those institutions recognize fair value losses on their private-label portfolios under GAAP, Fannie Mae and Freddie Mac may have to do so as well,'' the Washington-based regulator wrote in the report.

First, as a liquidity backstop, the plan includes a temporary increase in the line of credit the GSEs have with Treasury. Treasury would determine the terms and conditions for accessing the line of credit and the amount to be drawn.

Second, to ensure the GSEs have access to sufficient capital to continue to serve their mission, the plan includes temporary authority for Treasury to purchase equity in either of the two GSEs if needed.

Use of either the line of credit or the equity investment would carry terms and conditions necessary to protect the taxpayer.

Third, to protect the financial system from systemic risk going forward, the plan strengthens the GSE regulatory reform legislation currently moving through Congress by giving the Federal Reserve a consultative role in the new GSE regulator's process for setting capital requirements and other prudential standards.

Banks also are pulling back on the amount of rainy-day money they have been giving out to corporate clients in the form of loans called revolving-credit facilities. Retailers such as Sears Holdings Corp. and Talbots Inc. have struggled to renew revolving-credit facilities with their bankers in recent months. Other companies, including Wal-Mart Stores Inc., AT&T Inc. and American International Group Inc., have had to agree to tougher terms on such credit.

Overall, the value of credit held by banks in the second quarter shrank 1.5% from the first quarter, according to Federal Reserve data. That was the largest three-month contraction since 1948.

These tight credit conditions are particularly worrisome because the Federal Reserve has responded aggressively since the credit crunch emerged last July. The central bank has cut interest rates seven times by a total of 3.25 percentage points.

Much of the decline in outstanding credit has been due to banks sharply reducing the amount of bonds and other debt securities held on their books, but the slowdown is apparent across all forms of lending. The heavy losses banks have taken on mortgage-related securities are forcing them raise cash levels, leading to tighter lending. Because they can't know what other problems might be lurking on their balance sheets, they are being especially cautious.