Ben is talking today. Before you read further, please remember this. Before the last Fed meeting there were three very dovish Fed speeches. This led the markets to believe the Fed was going to cut rates by 50 basis points. The Fed wound up cutting 25 basis points which led the market to take a big hit. In other words, I'm not sure how to interpret anything the Fed says right now. However, we still have to know what the Fed is thinking so here are the

relevant portions of the speech:As you will recall, the U.S. economy experienced a mild recession in 2001. During the ensuing recovery, above-trend growth was accompanied by rising rates of resource utilization, particularly after the expansion picked up steam in mid-2003. Notably, the civilian unemployment rate declined from a high of 6.3 percent in June 2003 to 4.4 percent in March 2007. As the economy approached full employment, the Federal Open Market Committee (FOMC), the monetary policymaking arm of the Federal Reserve System, was faced with the classic problem of managing the mid-cycle slowdown--that is, of setting policy to help guide the economy toward sustainable growth without inflation. With that objective, the FOMC implemented a sequence of rate increases, beginning in mid-2004 and ending in June 2006, at which point the target for the federal funds rate was 5.25 percent--a level that, in the judgment of the Committee, would best promote the policy objectives given to us by the Congress. The economy continued to perform well into 2007, with solid growth through the third quarter and unemployment remaining near recent lows. Indicators of the underlying inflation trend, such as core inflation, showed signs of moderating.

Short version: after lowering rates to a level not seen for generations and low rates at which everybody and their brother was borrowing money, we decided to raise rates in an attempt to engineer a "soft landing". Of course, this has never worked before, but we had to look like we were doing something; we are the Fed after all.

However, the situation was complicated by a number of factors. Continued increases in the prices of energy and other commodities, together with high levels of resource utilization, kept the Committee on inflation alert. But perhaps an even greater challenge was posed by a sharp and protracted correction in the U.S. housing market, which followed a multiyear boom in housing construction and house prices. Indicating the depth of the decline in housing, according to the most recent available data, housing starts and new home sales have both fallen by about 50 percent from their respective peaks.

Short version: Record low interest rates led to a huge over-supply of homes -- but we won't admit that lowering rates to 0% after adjusting for inflation had anything to do with the housing bubble. And -- the Fed can't do anything about asset bubbles even though we have an awful lot to do with the creation of said bubbles.

In all likelihood, the housing contraction would have been considerably milder had it not been for adverse developments in the subprime mortgage market. Since early 2007, financial market participants have been focused on the high and rising delinquency rates of subprime mortgages, especially those with adjustable interest rates (subprime ARMs). Currently, about 21 percent of subprime ARMs are ninety days or more delinquent, and foreclosure rates are rising sharply.

Although poor underwriting and, in some cases, fraud and abusive practices contributed to the high rates of delinquency that we are now seeing in the subprime ARM market, the more fundamental reason for the sharp deterioration in credit quality was the flawed premise on which much subprime ARM lending was based: that house prices would continue to rise rapidly. When house prices were increasing at double-digit rates, subprime ARM borrowers were able to build equity in their homes during the period in which they paid a (relatively) low introductory (or “teaser”) rate on their mortgages. Once sufficient equity had been accumulated, borrowers were often able to refinance, avoiding the increased payments associated with the reset in the rate on the original mortgages. However, when declining affordability finally began to take its toll on the demand for homes and thus on house prices, borrowers could no longer rely on home-price appreciation to build equity; they were accordingly unable to refinance and found themselves locked into their subprime ARM contracts. Many of these borrowers found it difficult to make payments at even the introductory rate, much less at the higher post-adjustment rate. The result, as I have already noted, has been rising delinquencies and foreclosures, which will have adverse effects for communities and the broader economy as well as for the borrowers themselves.

Short version: The Federal Reserve and the Treasury department -- which oversea the nation's financial industry -- didn't really do much to prevent the bad practices that led to the poor underwriting standards. Therefore, that can't be the fundamental problem. Instead, the real problem was the pie in the sky fantasies of speculators who thought home prices would go up forever, which the lowest interest rates of a generation helped to create (even though we won't admit to that either).

One of the many unfortunate consequences of these events, which may be with us for some time, is on the availability of credit for nonprime borrowers. Ample evidence suggests that responsible nonprime lending can be beneficial and safe for the borrower as well as profitable for the lender. For example, even as delinquencies on subprime ARMs have soared, loss rates on subprime mortgages with fixed interest rates, though somewhat higher recently, remain in their historical range. Some lenders, including some who have worked closely with nonprofit groups with strong roots in low-to-moderate-income communities, have been able to foster homeownership in those communities while experiencing exceptionally low rates of default. Unfortunately, at this point, the market is not discriminating to any significant degree between good and bad nonprime loans, and few new loans are being made.

Short version: Even though we should have been keeping an eye on the ball about all of those underwriting standards and disclosure requirements, it's still a good idea to extend gobs of credit to everybody and their brother so long as it's done responsibly (and if you actually understand that, I am truly amazed).

Although subprime borrowers and the investors who hold these mortgages are the parties most directly affected by the collapse of this market, the consequences have been felt much more broadly. I have already referred to the role that the subprime crisis has played in the housing correction. On the way up, expansive subprime lending increased the effective demand for housing, pushing up prices and stimulating construction activity. On the way down, the withdrawal of this source of demand for housing has exacerbated the downturn, adding to the sharp decline in new homebuilding and putting downward pressure on house prices. The addition of foreclosed properties to the inventories of unsold homes is further weakening the market.

Short version: because everybody has some exposure to the subprime slime that is literally in every nook and cranny of the economy, everybody is really worried about the long-term effects. Therefore, lending activity has ground to a halt while we try and get a handle on exactly what to do.

OK -- let me vent about this.

1.) I am sick of the Fed not making this basic connection:

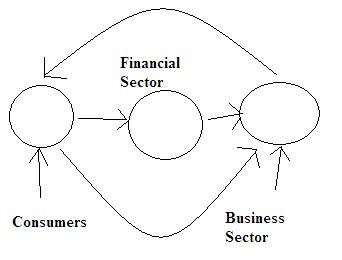

low interest rates increase the demand for loans which is a fundamental reason why we're in this mess. This is econ 101, and yet no one who is responsible for setting interest rate policy makes this claim in any way, shape or form. It's as though they are operating in a vacuum which considering all of the combined economic degrees in the bunch is absurd (at best).

2.) When asset prices whose value is partially based on interest rates skyrocket there is a problem. While I understand the Fed is basically saying, "we don't want to determine asset prices"

the bottom line is their primary responsibility (setting interest rate policies) has by definition an impact on asset prices. In other words, when they rescue the economy from a recession they want all of the credit, but when the economy has a big problem because of Fed policies that by definition created the problem, then it's the market fault.

3.) I think it's time we came to an understanding: not everyone should own a home. Yes, I know that makes me a bastard first class. But the bottom line is pretty clear:

it seems that a homeownership rate about 3%-5% below current levels is about the proper level of ownership. There's a reason people have poor credit:

they have a demonstrated record of irresponsibility. Do we really want to extend them gobs of credit, or do we instead want to figure out a way to encourage them to become more responsible?