There is growing talk about the possibility of international economies preventing a collapse of the US economy.

On Friday I posted this article where I noted that large US companies are reporting weak US sales but strong international sales.

The Big Picture quoted this point from

this weekend's Barron's (subscription required):THE REST OF THE WORLD IS CARRYING THE U.S. STOCK MARKET. Fast-galloping overseas economies, flush world capital markets and a sagging dollar fatten multinationals' earnings and furnish the fuel for commodity-related stocks to surge.

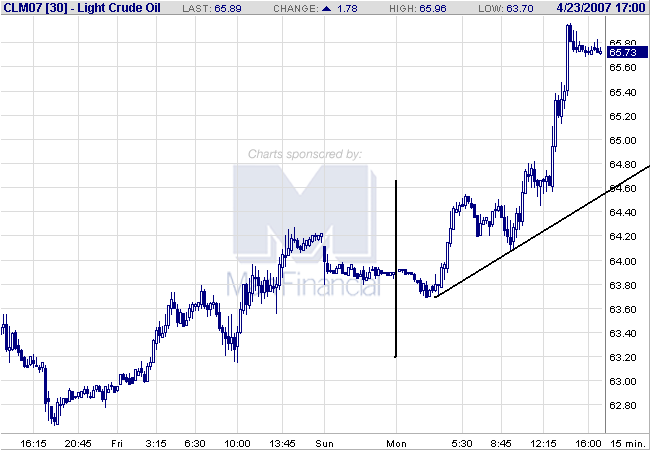

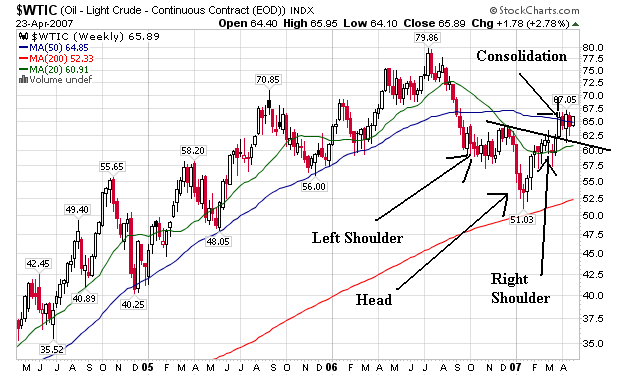

That's the takeaway from the earnings beats by Caterpillar (CAT) and Honeywell (HON) last week, the 22% jump in the Philadelphia Steel Producers index since March 5, the continued outperformance of foreign stock indexes, the seven-month high in copper and the run toward $700 an ounce in gold.

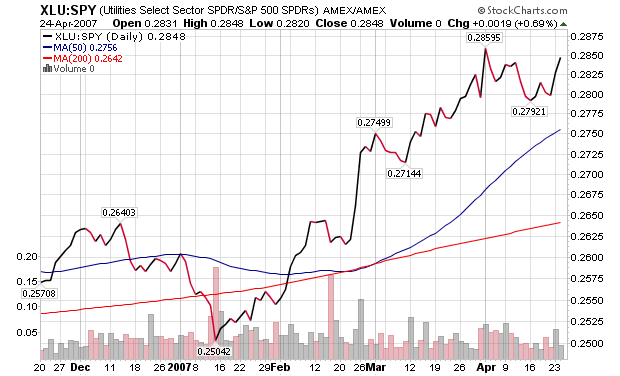

As a result, materials stocks are the new momentum favorites, and more broadly, traditionally cyclical sectors are being treated and valued as perpetual-growth vehicles -- a process even extending to sectors like railroads and utilities, now considered implicit plays on the commodity-demand boom.

It's enough to make independent souls look for traditional growth stocks to (finally) to return to favor. Quantitative strategist Joe Mezrich of Nomura notes that among all the stock factors he tracks, "long-term expected earnings growth" -- a long-term dog of a performance driver -- recently perked up, and it tends to be a decent signal of a growth revival when it does so.

Let me add two additional points to the above.

1.)

This report from the International Monetary Fund titled World Economic Outlook highlights that

the rest of the world is doing pretty well. Growth is fair in most other regions. In general, the IMF is projecting growth to at least continue on its present trajectory. If that continues, publicly traded US companies with sufficient international exposure will continue to see either earnings increases or insufficient earnings decreases to prevent a large loss of stock market value. In other words,

assuming earnings are a prime driver of stock prices, we won't see a major correction although we could see a difficult rally going forward because of domestic economic problems.

2.) About a week ago I posted an article based on

Marc Faber's observations that while debt was the primary source of consumer funds in the 2000 - 2005 period equity appreciation was the primary source for consumer funds from roughly 2006 on. This information comes from the household net worth tables from the Federal Reserve's

Flow of Funds Report. For the sake of argument, let's assume this is true -- that increased equity valuations are boosting or supporting consumer spending. If point number 1 is true -- that US companies have sufficient international exposure to mitigate a shortfall in US earnings -- than the natural corollary is consumer spending will be supported by equity prices.

Let's simplify the above to a few bullet points.

1.) International economies are doing pretty well.

2.) US companies with sufficient international sales will continue to see increased sales from stronger international economies.

3.) Increased international sales will mitigate the effects of slowing US growth on corporate earnings.

4.) If corporate earnings growth slows

but does not contract the market's overall level and value will be sustained.

5.) If increased equity prices are supporting US consumer spending, than slightly increasing or stable equity values will continue to support US consumer spending.

6.) Consumer spending is responsible for 70% of US economic growth. So long as consumer spending expands, it will mitigate the effect of the housing and capital expenditure slowdown.

That's about as simple as I can make this.