Saturday, March 17, 2007

Can You Say Flight to Qualtiy?

From Barron's. Utilities were the only industry to gain last week. Also not that financial shares -- which contain subprime mortgage lending and are the largest percentage component of the S&P 500 -- were the biggest looser.

Last Week in Review

I finally broke down a few months ago and got a subscription to Barron's which has been one of my favorite financial publications for a really long time. The following excerpt is from their weekly market wrap (subscription required):

This article highlights two important trends. The first is simple US market strength. When the big financial heads talk about the US markets being deep and robust, they are talking about a combination of factors -- overall confidence in the economy, sophisticated analysis, overall a pretty good spreading out of risk etc... When the author above notes all of the problems the US market has weathered in the last 5-6 years, these factors are an underpinning of his statements.

In addition, the damage from the housing and auto sector's problems has been contained. I should add the important caveat: so far. We still have a while to go before either of these sectors hits bottom, so it's still possible the negative effects will bleed into the national economy.

So -- the US markets are resilient.

HOWEVER, the subprime problems of the last few months have once again raised understandable concern about how resilient the US economy is. When the author is talking about people sniffing around for problems, this is what he is talking about. Right now the market is still trying to figure out the complete impact of the subprime shakeout. Frankly, we don't know its complete impact, so everybody is looking for signs that problems have bled into another area.

Psychologically, these are the two forces competing righting now.

Whether the recent pullback will prove prescient, or become yet another premature over-reaction, remains to be seen. The ferocity of Tuesday's selling -- declining stocks outpaced advancing ones, 10 to 1 -- certainly suggests a vigilant crowd sniffing for the first whiff of trouble.

"That intensity has less to do with the market's fundamentals than its mindset -- the mindset of a market looking for a crisis," says James Paulsen, Wells Capital Management's chief investment strategist. He ticked off a litany of "crises" that had menaced the economy since this bull market began, including the Iraq war, the jobless recovery in 2003, interest-rate hikes that began in 2004, the bird-flu scare, the oil-price surge, Hurricane Katrina, the 2006 inflation scare, the flat-yield curve and, now, the subprime spill. "Each time, caution has persisted, and that has allowed the bull run to persist," he says.

While the housing and auto segments contracted by an alarming 10% last year, these make up 9% of real gross domestic product. The rest of the economy expanded 4.3% in 2006. "For widespread fears of continued economic weakness to prove correct, both housing and autos will need to keep collapsing this year," Paulsen says.

This article highlights two important trends. The first is simple US market strength. When the big financial heads talk about the US markets being deep and robust, they are talking about a combination of factors -- overall confidence in the economy, sophisticated analysis, overall a pretty good spreading out of risk etc... When the author above notes all of the problems the US market has weathered in the last 5-6 years, these factors are an underpinning of his statements.

In addition, the damage from the housing and auto sector's problems has been contained. I should add the important caveat: so far. We still have a while to go before either of these sectors hits bottom, so it's still possible the negative effects will bleed into the national economy.

So -- the US markets are resilient.

HOWEVER, the subprime problems of the last few months have once again raised understandable concern about how resilient the US economy is. When the author is talking about people sniffing around for problems, this is what he is talking about. Right now the market is still trying to figure out the complete impact of the subprime shakeout. Frankly, we don't know its complete impact, so everybody is looking for signs that problems have bled into another area.

Psychologically, these are the two forces competing righting now.

Friday, March 16, 2007

The Markets Today

At least it's Friday. The markets meandered traded in different ways today.

The SPYs couldn't find a bottom until after 3PM EST. While they rallied after that, note the heavy volume of selling at the end. If the selling had started sooner there may have been a big end-of-the-day sell-off.

The QQQQs were down a touch (.09%), largely because of the strong computer industrial production figure. Traders were obviously looking for a tech rebound. But notice that like the SPYs there was a big volume spike at the end of the day.

The IWNs just couldn't get any momentum today. They hit the same floor twice, tried to rally from there and just couldn't make it.

Short version -- the markets just aren't that happy right now.

The SPYs couldn't find a bottom until after 3PM EST. While they rallied after that, note the heavy volume of selling at the end. If the selling had started sooner there may have been a big end-of-the-day sell-off.

The QQQQs were down a touch (.09%), largely because of the strong computer industrial production figure. Traders were obviously looking for a tech rebound. But notice that like the SPYs there was a big volume spike at the end of the day.

The IWNs just couldn't get any momentum today. They hit the same floor twice, tried to rally from there and just couldn't make it.

Short version -- the markets just aren't that happy right now.

Industrial Production Ramps Up

From the Federal Reserve:

The big increase came in consumer goods which increased a very large 1.5%, and utilities which increased 6.7%.

We've been getting a mixed signal from the industrial/manufacturing statistics for the last few months. The regional Fed surveys have been mixed, the ISM is hovering around neutral, yet the industrial production number jumped a pretty large 1% in March.

It's important to remember this jump was in two areas, one of which (utilities) can be attributed to weather related issues. In addition, the downward GDP revision from earlier this month was attributed to a technical inventory issue. Commentators noted because of the downward revision in inventories industrial production would have to increase. It appears that is happening.

Industrial production increased 1.0 percent in February after a decrease of 0.3 percent in January and a rise of 0.8 percent in December. Output in the manufacturing sector gained 0.4 percent in February and was led by increases in motor vehicles and in high-technology goods. The output of utilities jumped 6.7 percent in February, as colder-than-average temperatures boosted production at both electric and natural gas utilities. The output of mines edged up 0.1 percent. At 113.1 percent of its 2002 average, overall industrial production for the month was 3.4 percent above its year-earlier level. The rate of capacity utilization for total industry in February rose 0.6 percentage point, to 82.0 percent, a level 1.0 percentage point above its 1972-2006 average.

The big increase came in consumer goods which increased a very large 1.5%, and utilities which increased 6.7%.

We've been getting a mixed signal from the industrial/manufacturing statistics for the last few months. The regional Fed surveys have been mixed, the ISM is hovering around neutral, yet the industrial production number jumped a pretty large 1% in March.

It's important to remember this jump was in two areas, one of which (utilities) can be attributed to weather related issues. In addition, the downward GDP revision from earlier this month was attributed to a technical inventory issue. Commentators noted because of the downward revision in inventories industrial production would have to increase. It appears that is happening.

CPI Up .4%

From the BLS:

Food increased .8% -- the highest move in a year. It increased .7% in January. The compounded annual 3-month food index is 6.1%. In other words, agricultural price spikes noted yesterday are starting to bleed through to consumer prices.

CBS Marketwatch noted:

Energy prices increased .9% and their compound 3-month growth rate is 14.9%. In other words, the more volatile elements of the index are rising pretty fast right now.

The unadjusted 12-month rate is 2.4% -- .4% above the Fed's comfort zone.

Here's how Bloomberg reported this news:

The Consumer Price Index for All Urban Consumers (CPI-U) increase 0.5 percent in February, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The February level of 203.499 (1982-84=100) was 2.4 percent higher than in February 2006.

Food increased .8% -- the highest move in a year. It increased .7% in January. The compounded annual 3-month food index is 6.1%. In other words, agricultural price spikes noted yesterday are starting to bleed through to consumer prices.

CBS Marketwatch noted:

Food prices jumped for the second straight month, rising 0.8% -- the largest gain in nearly two years. Prices for fresh fruit rose 5.7%, the most in 19 years, while fresh vegetable prices also rose by 5.7%. Read the full government report.

Cold weather in California has damaged some crops, sending prices higher. Corn -- a primary input for many food items -- has also increased in price as more of the crop gets earmarked for ethanol production.

Energy prices increased .9% and their compound 3-month growth rate is 14.9%. In other words, the more volatile elements of the index are rising pretty fast right now.

The unadjusted 12-month rate is 2.4% -- .4% above the Fed's comfort zone.

Here's how Bloomberg reported this news:

Prices paid by U.S. consumers rose 0.4 percent last month, paced by gains in fuel, food and medical care that highlight Federal Reserve concerns over inflation.

The increase in the consumer price index followed a 0.2 percent January rise, the Labor Department said today in Washington. Core prices, which exclude food and energy, rose 0.2 percent and were 2.7 percent higher than a year earlier.

Combined with last month's jump in wholesale prices, the figures make it tougher for the Fed to lower rates should the mortgage crisis cause the economy to stumble. Policy makers are forecast to leave their benchmark interest rate unchanged for a sixth time when they meet next week.

``Inflation is running faster than the Fed would like it to run,'' Michael Moran, chief economist at Daiwa Securities America Inc. in New York, said before the report. ``They believe it will fall gradually on its own as economic growth eases and they'll be patient in reacting to the numbers.''

Dollar Update

From Bloomberg:

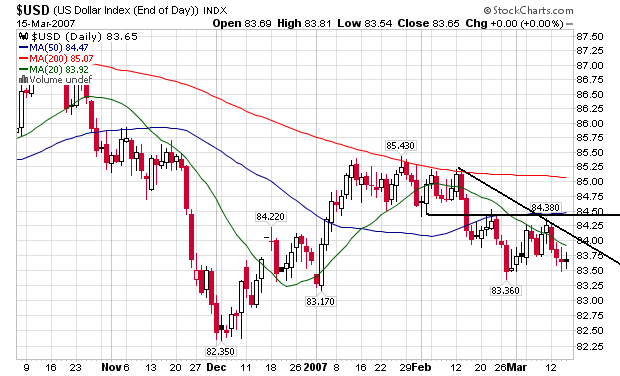

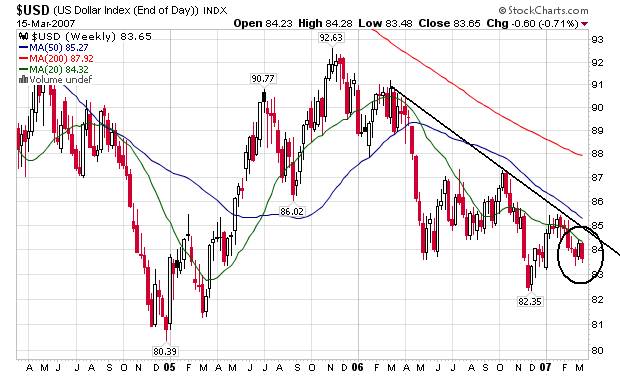

Let's look at the daily and weekly charts from Stockcharts. Here's the daily chart:

From a technical perspective, notice the latest rally didn't even hit resistance established in late January/early February. Instead the average reversed a bit above the 20-day SMA. Also notice that instead of breaking out once it crossed the 20-day SMA, the dollar index reversed. All of this simply says there is a lack of upward momentum in the dollar index.

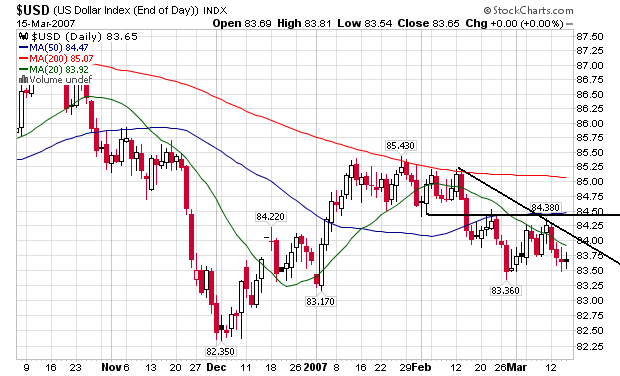

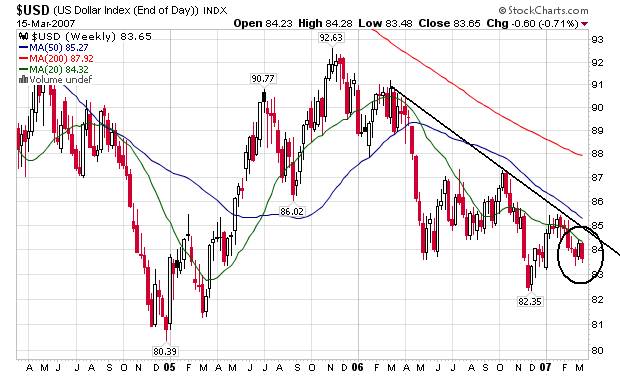

Here's the weekly chart:

We're still firmly in a downtrend. In fact, as we approached the downtrend line we reversed with a strong bar which is in the circled area. All this means there is a strong bearish sentiment on the weekly chart.

The dollar slid to the lowest level this year against the euro before a U.S. consumer-confidence report that may reinforce concern economic growth is slowing.

The U.S. currency also headed for the biggest weekly loss since early December on speculation rising numbers of homebuyers with poor credit histories will fail to pay back loans. Signs that a housing slowdown is feeding through to consumption are also hurting the dollar. Global stocks fell today, adding to losses this month that may weigh on spending by individuals.

``The U.S. dollar is under pressure,'' said Hans Guenter Redeker, head of currency strategy at BNP Paribas SA in London. ``The U.S. economy is weakening'' and with ``the interest rate gap closing, obviously you want to have euros, not dollars.''

Let's look at the daily and weekly charts from Stockcharts. Here's the daily chart:

From a technical perspective, notice the latest rally didn't even hit resistance established in late January/early February. Instead the average reversed a bit above the 20-day SMA. Also notice that instead of breaking out once it crossed the 20-day SMA, the dollar index reversed. All of this simply says there is a lack of upward momentum in the dollar index.

Here's the weekly chart:

We're still firmly in a downtrend. In fact, as we approached the downtrend line we reversed with a strong bar which is in the circled area. All this means there is a strong bearish sentiment on the weekly chart.

China Approves Property Laws

From the NYTimes:

First a BIG caveat: I have no knowledge of internal Chinese politics, nor do I have any knowledge of its legal system. Therefore I can't comment on the sincerity of this law.

But, this is a very interesting development from a historical perspective. A passing analysis of democratic development indicates property rights are an essential element in the democratic development. I think you can successfully argue that the growth of the middle class was in fact a primary reason for Democratic development during the Renaissance.

After more than a quarter-century of market-oriented economic policies and record-setting growth, China on Friday enacted its first law to protect private property explicitly.

The measure, which was delayed a year ago amid vocal opposition from resurgent socialist intellectuals and old-line, left-leaning members of the ruling Communist Party, is viewed by its supporters as building a new and more secure legal foundation for private entrepreneurs and the country’s urban middle-class home and car owners.

But delays in pushing it through the Communist Party’s generally pliant legislative arm, the National People’s Congress, and a ban on news media discussion of the proposal, raise questions about the underlying intentions and the governing style of President Hu Jintao and Prime Minister Wen Jiabao, experts say.

First a BIG caveat: I have no knowledge of internal Chinese politics, nor do I have any knowledge of its legal system. Therefore I can't comment on the sincerity of this law.

But, this is a very interesting development from a historical perspective. A passing analysis of democratic development indicates property rights are an essential element in the democratic development. I think you can successfully argue that the growth of the middle class was in fact a primary reason for Democratic development during the Renaissance.

Thursday, March 15, 2007

More Agricultural Price Charts

The Markets Today

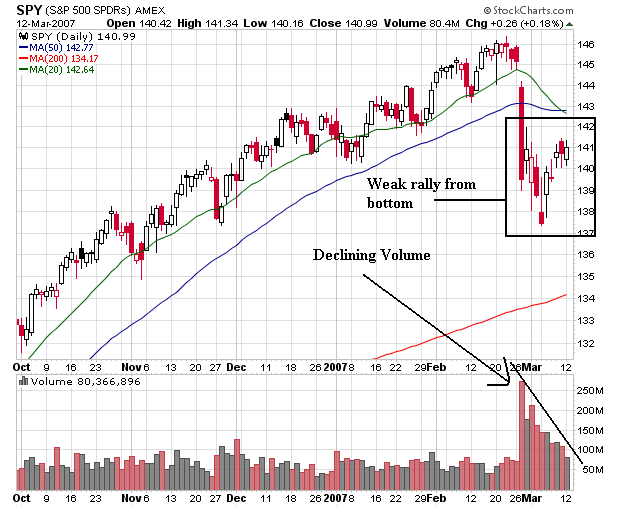

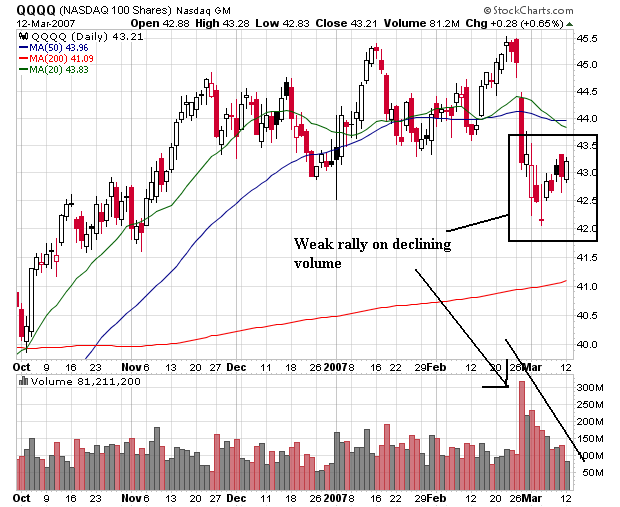

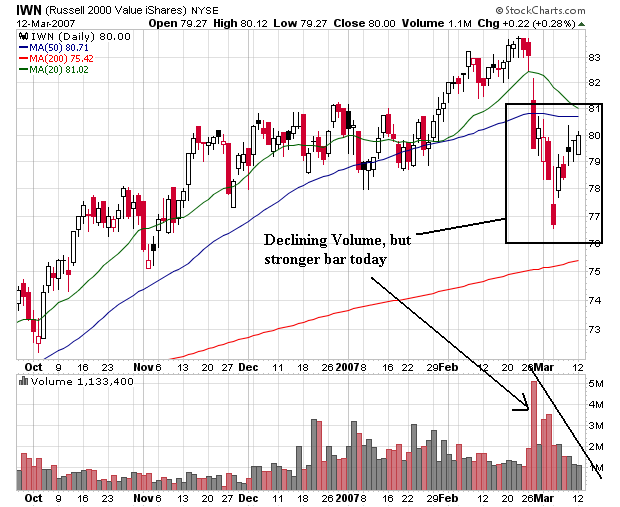

Instead of looking at an intra-day chart, today I wanted to look at the 3-month daily charts for the SPYs, QQQQs and IWNs. It's been a few weeks since the first big sell-off, so the markets have had time to absorb that loss and figure out where they're going.

Here's the SPYs and IWNs

The most bullish interpretation of both these charts is they are forming a double bottom or triangge consolidation. A double bottom is a reversal pattern, meaning it occurs at tops or bottoms. If this is the case, then the market should rally from here If this is a triangle formation it can be either a reversal or continuation pattern (meaning a pattern that occurs in the middle of a trend). If that is the case we need the market to move decisively in one direction or another to confirm the trend.

Because there are multiple and conflicting technical interpretations of the current market fundamental considerations are more important than usual. Fundamentally we've had a ton of bad news over the last few weeks. Subprime mortgage problems abound; manufacturing is hovering between expansion and contraction and producer prices increased more than estimated which hems in the Fed. In other words, the fundamental backdrop clearly favors the bears.

Here's a chart for the QQQQs:

This is what Gartley would call a "complex" formation, which means it's difficult to categorize conclusively. I think of these patterns as rectangle patterns, largely because you can draw a rectangle around it. There is the possibility of a double bottom and a triangle, but neither formation are very strong.

All of the previous fundamental analysis still applies.

Short version: we're still waiting for confirmation in either direction, but the fundamental picture is not promising.

Here's the SPYs and IWNs

The most bullish interpretation of both these charts is they are forming a double bottom or triangge consolidation. A double bottom is a reversal pattern, meaning it occurs at tops or bottoms. If this is the case, then the market should rally from here If this is a triangle formation it can be either a reversal or continuation pattern (meaning a pattern that occurs in the middle of a trend). If that is the case we need the market to move decisively in one direction or another to confirm the trend.

Because there are multiple and conflicting technical interpretations of the current market fundamental considerations are more important than usual. Fundamentally we've had a ton of bad news over the last few weeks. Subprime mortgage problems abound; manufacturing is hovering between expansion and contraction and producer prices increased more than estimated which hems in the Fed. In other words, the fundamental backdrop clearly favors the bears.

Here's a chart for the QQQQs:

This is what Gartley would call a "complex" formation, which means it's difficult to categorize conclusively. I think of these patterns as rectangle patterns, largely because you can draw a rectangle around it. There is the possibility of a double bottom and a triangle, but neither formation are very strong.

All of the previous fundamental analysis still applies.

Short version: we're still waiting for confirmation in either direction, but the fundamental picture is not promising.

Philly Fed Stalls

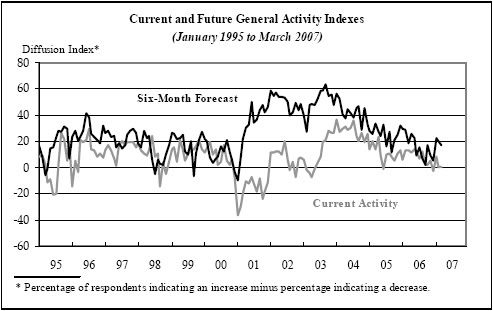

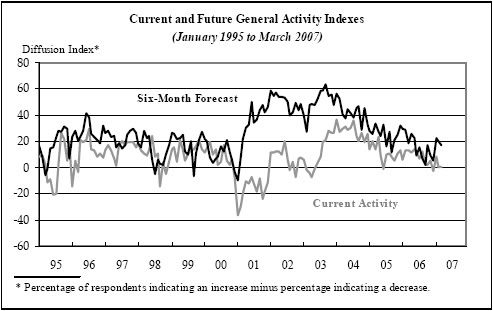

This chart from the report says it all.

Business conditions are hovering around zero. They have been here before and bounced, so this might not be a predictor of future problems.

But the usual 6-month enthusiasm has decreased a bit:

This is a weak report as well. Overall business conditions are hovering between expansion and contraction.

Here's a link to the full report -- Here's a PDF

Business conditions are hovering around zero. They have been here before and bounced, so this might not be a predictor of future problems.

But the usual 6-month enthusiasm has decreased a bit:

The outlook for manufacturing growth over the next six months showed a slight moderation this month. The future general activity index fell three points, and most of the other future indicators followed suit: The index for future new orders decreased four points, and future shipments decreased one point. Firms were also less optimistic about future growth in employment. The future employment index decreased eight points; 25 percent of the firms expect to increase employment over the next six months, and 16 percent expect to decrease it.

This is a weak report as well. Overall business conditions are hovering between expansion and contraction.

Here's a link to the full report -- Here's a PDF

Empire State Index Drops Big

Here is a link to the PDF report

The general business conditions index dropped from 24.3 to 1.8. That's the biggest drop we have seen in a year. The index increased last month, but that was obviously a one-time pop. I'm thinking it may have been simple enthusiasm for the new year.

New orders decreased from 19 to 3. This is another very large drop -- one that has not happened in the last year.

Prices paid increased slightly from 27 to 30.

This is a bad report, plain and simple. It shows a sharp decline in the present business conditions.

The general business conditions index dropped from 24.3 to 1.8. That's the biggest drop we have seen in a year. The index increased last month, but that was obviously a one-time pop. I'm thinking it may have been simple enthusiasm for the new year.

New orders decreased from 19 to 3. This is another very large drop -- one that has not happened in the last year.

Prices paid increased slightly from 27 to 30.

This is a bad report, plain and simple. It shows a sharp decline in the present business conditions.

PPI + 1.3%, Core +.4%; Agricultural Price Spikes Hit Numbers

From the BLS:

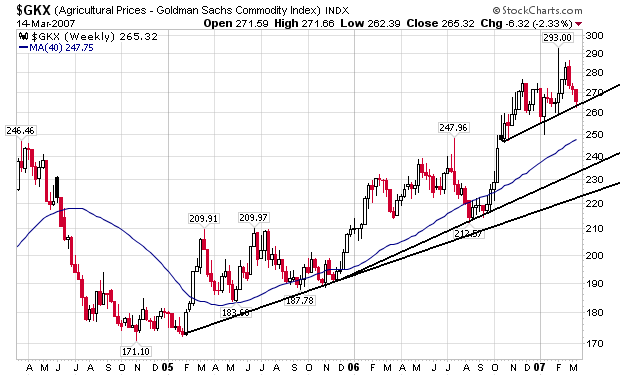

Food increased 1.9%. They rose 1.5% in December and 1.1% in January. In the year before they would occasionally spike 1.1%, but never with gains like we have seen for the past three months. Let's look at some future's charts, because they tell an as-of-yet untold tale. Agricultural prices are spiking.

Weekly Wheat Chart:

Feed Wheat Weekly:

Corn Weekly:

Barley Weekly:

Each of these charts has about 2 1/4 years of information, so we're not looking at seasonal price fluctuations (which futures were originally designed to help ameliorate). We're looking at damn big price moves in agricultural prices. Don't expect the food component of PPI to come down anytime soon.

The Producer Price Index for Finished Goods advanced 1.3 percent in February, seasonally adjusted, the Bureau of Labor Statistics of the U.S.Department of Labor reported today. This increase followed a 0.6-percent decline in January and a 0.9-percent rise in December. At the earlier stages of processing, the intermediate goods index turned up 1.1 percent after falling 0.7 percent in the previous month, and prices for crude goods climbed 8.9 percent following a 6.3-percent decrease in January.

Food increased 1.9%. They rose 1.5% in December and 1.1% in January. In the year before they would occasionally spike 1.1%, but never with gains like we have seen for the past three months. Let's look at some future's charts, because they tell an as-of-yet untold tale. Agricultural prices are spiking.

Weekly Wheat Chart:

Feed Wheat Weekly:

Corn Weekly:

Barley Weekly:

Each of these charts has about 2 1/4 years of information, so we're not looking at seasonal price fluctuations (which futures were originally designed to help ameliorate). We're looking at damn big price moves in agricultural prices. Don't expect the food component of PPI to come down anytime soon.

H&R Block's Mortgage Unit Has More Problems

From the WSJ:

This brings up an interesting point. With all of subprime's current problems, it's natural for vulture investors to come in buying cheap assets; that's the market at work.

But, will subprime companies be able to sell their distressed assets at decent prices? Will the problems in subprime prevent deals from going through?

H&R Block Inc.'s disclosure of more losses on subprime mortgages is stirring up doubts about the planned sale of its home-lending business.

In a quarterly report filed with the Securities and Exchange Commission, the nation's largest tax preparer said it cut the carrying value of certain mortgage assets by an additional $29.2 million at its Option One unit, which, based on market share, ranked third last year among home-loan providers to people with scuffed credit.

H&R Block Chairman and Chief Executive Mark Ernst said "we are progressing as planned" with the anticipated sale of Option One and "remain committed to announce results and further steps by the end of this month." He previously has told analysts and investors that the Kansas City, Mo., company would expect the sale price of the mortgage arm to exceed its book value of $1.3 billion.

But skeptics abound. "It seems hard to believe that they can command anything near the price they are talking about for Option One in this market, if they can sell it at all," said analyst Kathleen Shanley at GimmeCredit, which says investors should "avoid" buying H&R Block bonds.

This brings up an interesting point. With all of subprime's current problems, it's natural for vulture investors to come in buying cheap assets; that's the market at work.

But, will subprime companies be able to sell their distressed assets at decent prices? Will the problems in subprime prevent deals from going through?

Trade Deficit Improves

This report came out a few days ago. But I've been a bit preoccupied with the markets so I'm getting to it now.

From the BEA

So we have some good news and bad news. The bad news is the trade deficit set another record last year, but the good news is it may be decreasing a bit.

OK - let's look at some specifics.

The goods and services press release stated:

Total exports were $114,405 billion in January 2006 and $126,672 in January 2007. Over the same period, total imports were $180,875 and $186,745. Another way to look at this is total exports are about 63% of imports in January 2006 and 68% of total imports in January 2007. That means that exports still have a long way to go before they are at parity with imports. In other words, the decrease is good news, but let's not get too excited.

Here is a report from the San Francisco Federal Reserve from late last summer. The report studied the effects of oil imports on the trade deficit. The reports conclusion was very important:

I think this report was incredibly important because it showed why oil imports are such a big deal from a trade perspective. Without oil imports, the trade deficit would be less by a considerable amount. This is another reason oil prices are so incredibly important to monitor.

So, what do we know now?

1.) The trade deficit is decreasing, although at a slow rate.

2.) Oil prices are a really big factor of the trade deficit.

From the BEA

A drop in oil prices and strong U.S. exports shrank the fourth-quarter deficit to $195.8 billion -- or about 5.8% of gross domestic product -- its smallest in more than a year. That compared with a third-quarter deficit of $229.4 billion.

So we have some good news and bad news. The bad news is the trade deficit set another record last year, but the good news is it may be decreasing a bit.

OK - let's look at some specifics.

The goods and services press release stated:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that total January exports of $126.7 billion and imports of $185.8 billion resulted in a goods and services deficit of $59.1 billion, compared with $61.5 billion in December, revised. January exports were $1.4 billion more than December exports of $125.3 billion. January imports were $1.0 billion less than December imports of $186.7 billion.

Total exports were $114,405 billion in January 2006 and $126,672 in January 2007. Over the same period, total imports were $180,875 and $186,745. Another way to look at this is total exports are about 63% of imports in January 2006 and 68% of total imports in January 2007. That means that exports still have a long way to go before they are at parity with imports. In other words, the decrease is good news, but let's not get too excited.

Here is a report from the San Francisco Federal Reserve from late last summer. The report studied the effects of oil imports on the trade deficit. The reports conclusion was very important:

Oil prices have almost quadrupled since the beginning of 2002. For an oil-importing country like the U.S., this has substantially increased the cost of petroleum imports. International trade data suggest that this increase has exacerbated the deterioration of the U.S. trade deficit, especially since the second half of 2004. One factor can explain this evolution: The real volume of U.S. petroleum imports has remained essentially constant. One explanation for why the demand for petroleum imports has not declined in response to higher prices comes from a model in which firms are fairly limited in their ability to adjust their use of energy sources, such as oil, in the short term.

I think this report was incredibly important because it showed why oil imports are such a big deal from a trade perspective. Without oil imports, the trade deficit would be less by a considerable amount. This is another reason oil prices are so incredibly important to monitor.

So, what do we know now?

1.) The trade deficit is decreasing, although at a slow rate.

2.) Oil prices are a really big factor of the trade deficit.

Wednesday, March 14, 2007

The Markets Today

What a difference a day makes. The markets were in much better shape today. Here are the SPYs, QQQQs and IWNs.

All of the markets started rallying at a bit before noon. All closed at or near their highs for the day. The QQQQs had a nice volume spike at the end.

I will add that today does feel like a technical bounce rather than the start of a new rally. Traders are conditioned to buy on the dips. In addition, no market goes down forever so some rebound is almost always in order after a large sell-off.

All of the markets started rallying at a bit before noon. All closed at or near their highs for the day. The QQQQs had a nice volume spike at the end.

I will add that today does feel like a technical bounce rather than the start of a new rally. Traders are conditioned to buy on the dips. In addition, no market goes down forever so some rebound is almost always in order after a large sell-off.

Import Prices Surprise on the Downside

From the BLS:

The best part of this report was the year over year change. From February 2006 to February 2007 import prices increased 1.3%.

However, take a look at the statements on oil:

Take a look at the chart below on oil. Remember we're going into the summer driving season.

From Bloomberg:

I would add, this is a Fed positive report for now. Oil still remains a wild card in deck.

The U.S. Import Price Index rose 0.2 percent in February, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The increase followed a 0.9 percent decline in January and was led by an upturn in petroleum prices. The price index for exports increased for the fourth consecutive month, advancing 0.7 percent in February.

The best part of this report was the year over year change. From February 2006 to February 2007 import prices increased 1.3%.

However, take a look at the statements on oil:

Prices for imports increased 0.2 percent in February as a 2.0 percent increase in petroleum prices more than offset a modest decline in nonpetroleum prices. The advance in petroleum prices followed declines in four of the previous five months, and despite the February upturn petroleum prices decreased 2.6 percent over the past year.

Take a look at the chart below on oil. Remember we're going into the summer driving season.

From Bloomberg:

Prices of U.S. imports rose less than forecast in February, held down by lower costs for metals and machinery that may help keep a lid on inflation.

The 0.2 percent increase followed a 0.9 percent drop in January, the Labor Department said today in Washington. Prices excluding petroleum fell 0.1 percent. Separate figures from the Commerce Department showed the current-account deficit shrank last quarter to $195.8 billion.

The cheapest imported business equipment in almost a year is among factors that may make it easier for the Federal Reserve to keep interest rates unchanged. Policy makers will see reports on wholesale and consumer prices in coming days as they prepare for next week's interest-rate meeting.

``This is definitely a Fed-positive report,'' said Ellen Zentner, an economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York. ``It supports the case for the Fed to sit tight and continue to watch inflation pressures recede.''

I would add, this is a Fed positive report for now. Oil still remains a wild card in deck.

GM Injects $1 Billion Into GMAC Because of Subprime Mortgages

From Reuters:

Let's look at this in more detail, because it raises some possibly scary issues.

GM sold GMAC. Part of the terms of the agreement said GMAC would be worth a minimum of $14.4 billion. After looking at the books again the curreny book value was obviously below the stated minimum value. To correct the problem, GM injected $1 billion dollars into GMAC.

Think about what that might mean. Does GMAC have $1 billion in losses or possible losses as the result of mortgage issues?

General Motors Corp. (NYSE:GM - News) will inject $1 billion into GMAC, its former finance arm said on Tuesday, a capital infusion needed to complete the sale of the automaker's majority stake in the face of escalating defaults in the U.S. mortgage market.

GMAC, which reported results on Tuesday, said that even after the equity injection from GM, "continuing pressures in the U.S. mortgage sector" would weigh on its future earnings.

Under terms of its sale to a group led by Cerberus Capital Management, GM had guaranteed a minimum book value of $14.4 billion when the sale closed at the end of November.

However, a recalculation of GMAC's book value revealed a shortfall caused by the mortgage losses that GM is now trying to address with the $1 billion cash injection this quarter.

Let's look at this in more detail, because it raises some possibly scary issues.

GM sold GMAC. Part of the terms of the agreement said GMAC would be worth a minimum of $14.4 billion. After looking at the books again the curreny book value was obviously below the stated minimum value. To correct the problem, GM injected $1 billion dollars into GMAC.

Think about what that might mean. Does GMAC have $1 billion in losses or possible losses as the result of mortgage issues?

Oil Market Update

From AFX News:

However, gas prices are still increasing, as shown by this chart from the latest DOE report:

Here's what the DOE said in their latest report:

Note two things. First, they said prices have increased sharply again. Those are two words you don't like to see in front of gas prices. Secondly, prices are higher than they were at this time last year when gas hit $3/gallon and above in some regions.

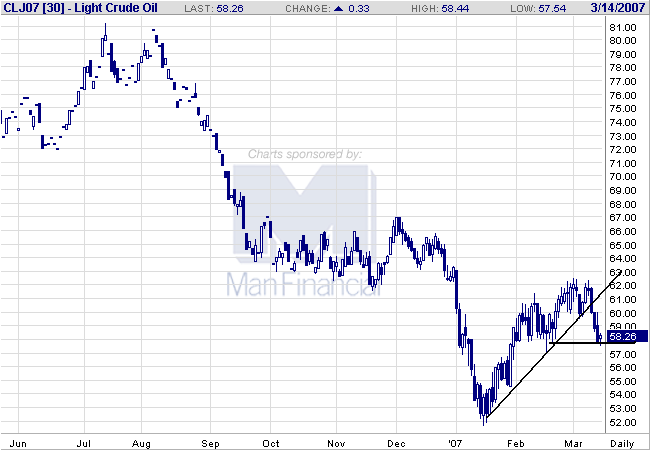

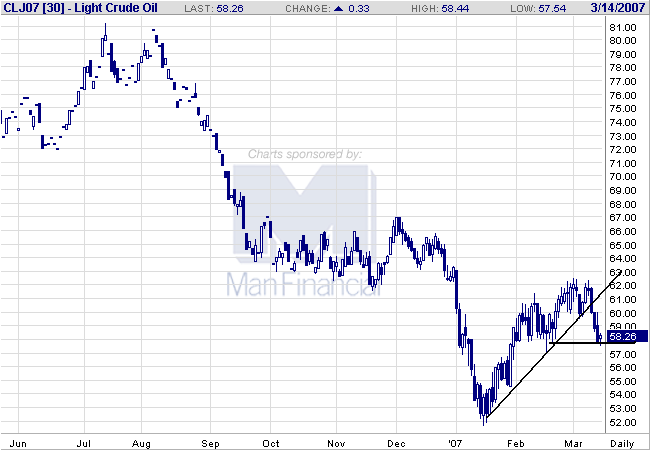

Here's a chart of oil:

Oil has sold-off and broken its rally that started in mid-January. So far, it appears to be bottoming at roughly $58/bbl.

Let's sum up so far. Crude oil prices are lower now than this time last year (when they were about $66-$70/bbl). However, gasoline prices are higher now than they were last year. What's odd is now we have a higher stockpile of gasoline than we did last year. Here's the chart of gasoline inventories, with last summer marked 1 and the current level marked 2:

We have more supply now (although it is dropping), but prices are higher. Gas prices may be moving up in response to the drop in inventories and the speed of the drop.

Maybe the issue is the overall oil inventory, which has dropped since the summer peak:

Why all of this talk about oil? In his latest Congressional testimony, Bernanke said inflation was down largely as the result of decreasing energy prices. Therefore, as energy prices increase we can probably expect an uptick in inflation. This will hem the Fed in and prevent them from lowering interest rates if there is a continued economic slowdown.

The US Energy Information Administration said crude oil stocks rose by 1.2 mln barrels in the week ending March 9 to a total of 325.3 mln barrels. The latest figure was in line with analysts' expectations of an increase of 1.3 mln barrels, according to an AFX poll.

However, gas prices are still increasing, as shown by this chart from the latest DOE report:

Here's what the DOE said in their latest report:

Gasoline prices rose sharply again, increasing 12.2 cents to 250.5 cents per gallon for the week of March 5, 2007. Prices are now 17.4 cents per gallon higher than at this time last year. All regions reported price increases. The East Coast had the largest increase, with prices up 15.4 cents to 249.1 cents per gallon. Midwest prices rose 9.5 cents to 246.5 cents per gallon. Prices for the Gulf Coast were up 13.3 cents to 236.7 cents per gallon. Rocky Mountain prices increased 10.4 cents to 235.3 cents per gallon, while prices for the West Coast were up 10.1 cents to 276.5 cents per gallon. California prices were also up 10.1 cents, to 289.7 cents per gallon, 41.7 cents per gallon above last year’s price.

Note two things. First, they said prices have increased sharply again. Those are two words you don't like to see in front of gas prices. Secondly, prices are higher than they were at this time last year when gas hit $3/gallon and above in some regions.

Here's a chart of oil:

Oil has sold-off and broken its rally that started in mid-January. So far, it appears to be bottoming at roughly $58/bbl.

Let's sum up so far. Crude oil prices are lower now than this time last year (when they were about $66-$70/bbl). However, gasoline prices are higher now than they were last year. What's odd is now we have a higher stockpile of gasoline than we did last year. Here's the chart of gasoline inventories, with last summer marked 1 and the current level marked 2:

We have more supply now (although it is dropping), but prices are higher. Gas prices may be moving up in response to the drop in inventories and the speed of the drop.

Maybe the issue is the overall oil inventory, which has dropped since the summer peak:

Why all of this talk about oil? In his latest Congressional testimony, Bernanke said inflation was down largely as the result of decreasing energy prices. Therefore, as energy prices increase we can probably expect an uptick in inflation. This will hem the Fed in and prevent them from lowering interest rates if there is a continued economic slowdown.

Asian Markets Tank

From the WSJ:

I guess we're returning the favor from a few weeks ago.....

Asian-Pacific markets fell sharply Wednesday in the wake of a sharp sell-off on Wall Street, with Japan's benchmark index falling 2.92% with exporters retreating as the yen strengthened against major currencies.

I guess we're returning the favor from a few weeks ago.....

More on Yesterday's Retail Sales

From the WSJ:

A few points.

1.) Retail sales were revised lower for the last few months. That means economists assumptions about consumer behavior are going to have to come down for their future projections, which will lower GDP growth estimates.

2.) Note that spending dropped across the board -- hobby stores, restaurants and sporting goods stores. Some of this may be a post-holiday slowdown. But with all of the bad housing news coming out, it's reasonable to assume consumers may be pulling in their spending habits.

3.) Personally, I've become less concerned about inventory numbers, largely because retailers (and anyone else who would traditionally keep inventory) have become incredibly adept at inventory management. The inventory to sales ratio at the national level has continued to drop while consumer spending has continued to rise. This tells me that inventory systems are pretty advanced.

In an email to clients, Haseeb Ahmed, U.S. economist with J.P. Morgan Chase & Co., noted that core retail sales -- a measure that excludes cars, gasoline and building supplies -- were down 0.2% in February, the weakest showing since March 2005. Core retail sales for January and December were weaker than originally reported: January was revised to 0.3% growth from a previously reported 0.4% growth; December was revised to 0.9% growth from 1%.

....

The retail-sales report also showed that spending at electronics-and-appliance stores fell 0.3%, the second straight month of decline, while sporting-goods and hobby stores were down 0.8%. Restaurants and bars were down 1.2%. Some economists say such data show consumers are getting more cautious. "The housing market is clearly weighing on consumers. I think they're looking at debt burdens that are very high and saying we need to pull in the reins a little bit," says Richard Moody, chief economist at Mission Residential, a real-estate investment firm in Austin, Texas.

Separately, the Commerce Department reported that seasonally adjusted business inventories were up 0.2% in January, compared with being flat in December. The retail-sales report, combined with the news about business inventories, prompted some economists to downgrade their forecasts of first-quarter gross domestic product, the broadest measure of economic output. Credit Suisse Group lowered its first-quarter GDP estimate to 2.0% from an earlier estimate of 2.5%. Macroeconomic Advisers LLC reduced its first-quarter GDP forecast to 1.7% from 2.1%.

A few points.

1.) Retail sales were revised lower for the last few months. That means economists assumptions about consumer behavior are going to have to come down for their future projections, which will lower GDP growth estimates.

2.) Note that spending dropped across the board -- hobby stores, restaurants and sporting goods stores. Some of this may be a post-holiday slowdown. But with all of the bad housing news coming out, it's reasonable to assume consumers may be pulling in their spending habits.

3.) Personally, I've become less concerned about inventory numbers, largely because retailers (and anyone else who would traditionally keep inventory) have become incredibly adept at inventory management. The inventory to sales ratio at the national level has continued to drop while consumer spending has continued to rise. This tells me that inventory systems are pretty advanced.

Tuesday, March 13, 2007

Country Wide CEO: "Mortgages Are in a Liquidity Crisis"

From Reuters:

Today we've had the second largest subprime lender delisted, another entering a period of problems and the largest subprime lender say mortgages are in a liquidity crisis.

I think all of this qualifies as a bad news day.

Countrywide Financial Corp. (CFC.N: Quote, Profile, Research) Chief Executive Angelo Mozilo said on Tuesday the U.S. mortgage sector is entering a "liquidity crisis," but that investors and speculators are overreacting by punishing healthier lenders as well as marginal ones.

"This is now becoming a liquidity crisis," and "it's going to get uglier," Mozilo said on CNBC television.

Mozilo said the winnowing out will be "great" for Countrywide, the largest U.S. mortgage lender, which might pick up market share.

He said investors and speculators, who have punished shares of many companies with mortgage exposure, have engaged in an "overreaction, a baby out with the bathwater." Still, he said the housing slowdown means "the economy will be impacted negatively, and the (Federal Reserve) will move interest rates down."

Today we've had the second largest subprime lender delisted, another entering a period of problems and the largest subprime lender say mortgages are in a liquidity crisis.

I think all of this qualifies as a bad news day.

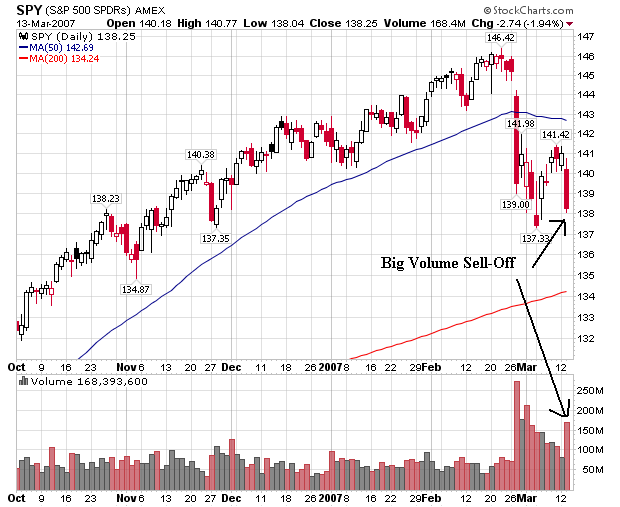

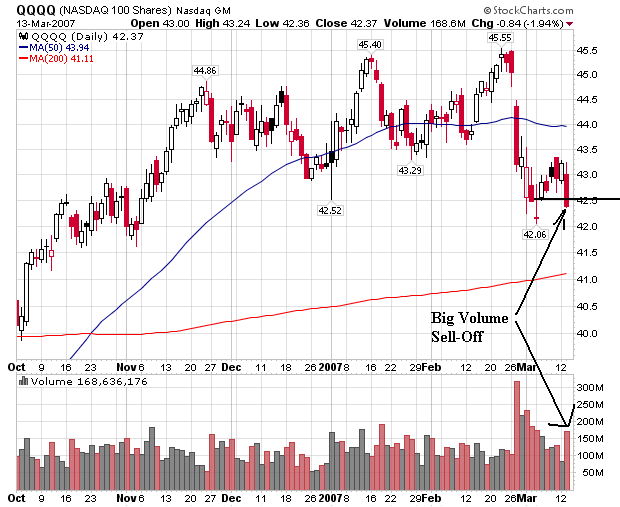

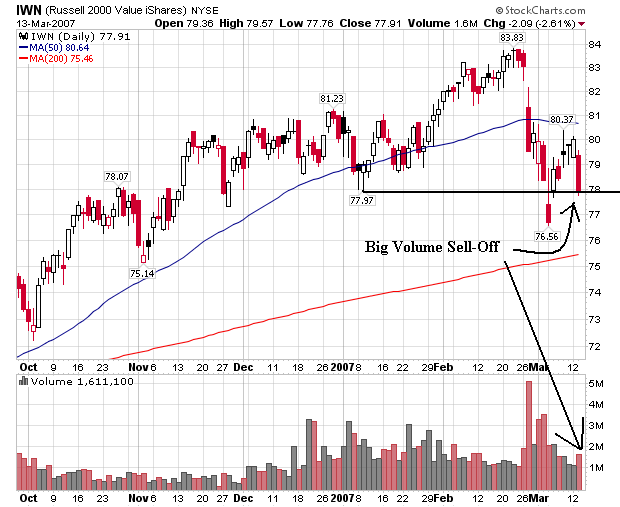

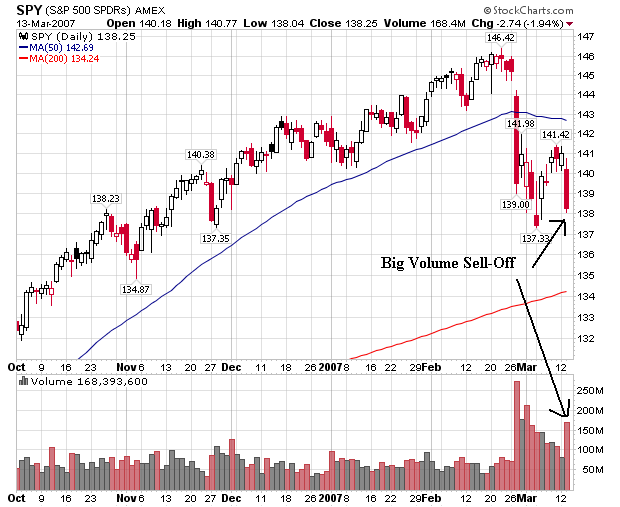

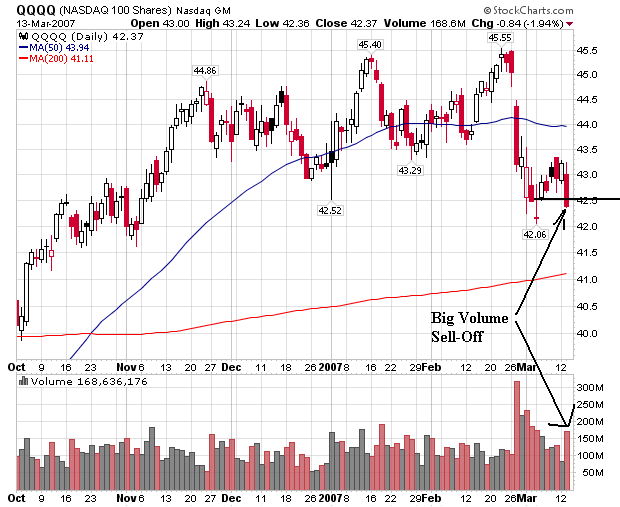

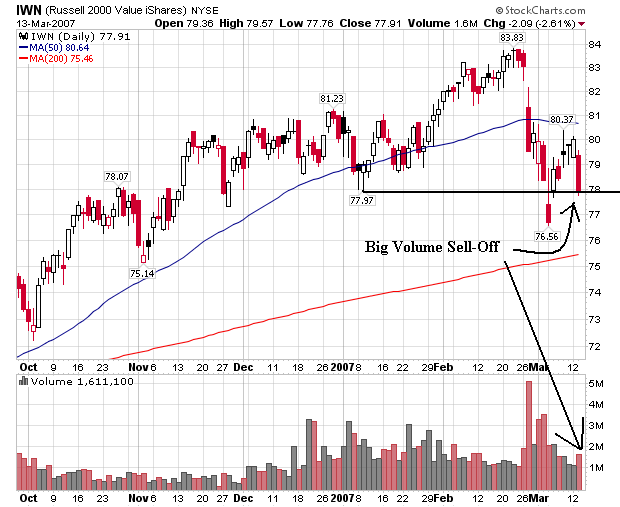

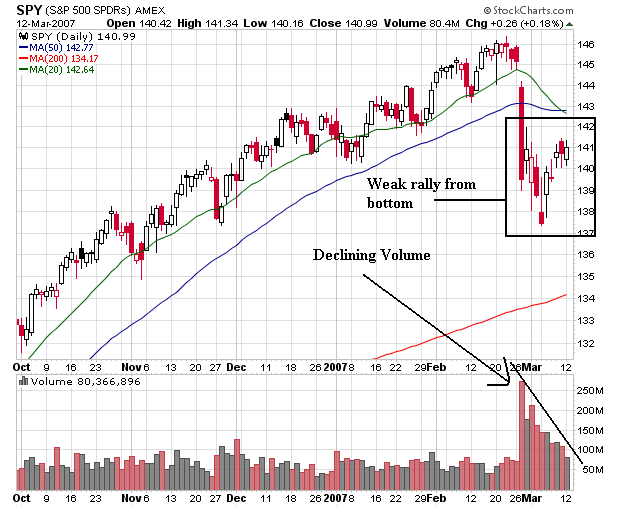

Today's Sell-Off In Perspective

Let's go to the daily chart to see what today did to the long-term charts. Here's the SPY, QQQ and IWN to see what happened

Several days ago I wrote the recent rally after the sell-off was suspect because of declining volume, but the declining volume may itself be suspect because it was coming down from a really high level. Well -- now we have confirmation. The rally was suspect.

You'll notice the same wording on each chart: big volume sell-off. Simply put, there were a ton of sellers in the market today, and they were looking to get out. They were willing to take a lower price to get out. That's one of the prime reasons for the drop.

Notice that technically, all the averages have a touch of breathing room -- but not much. Another bad day like today and the markets will be looking at a technical break-out on the downside.

Several days ago I wrote the recent rally after the sell-off was suspect because of declining volume, but the declining volume may itself be suspect because it was coming down from a really high level. Well -- now we have confirmation. The rally was suspect.

You'll notice the same wording on each chart: big volume sell-off. Simply put, there were a ton of sellers in the market today, and they were looking to get out. They were willing to take a lower price to get out. That's one of the prime reasons for the drop.

Notice that technically, all the averages have a touch of breathing room -- but not much. Another bad day like today and the markets will be looking at a technical break-out on the downside.

Another Subprime Lender In Trouble

From the Street.com

Just what the market needed -- another subprime lender with problems. Let the heads roll - again.

Accredited Home Lenders (LEND - Cramer's Take - Stockpickr - Rating) is facing a liquidity crisis that analysts say could leave it following in the footsteps of New Century (NEW - Cramer's Take - Stockpickr - Rating).

Accredited, a San Diego-based mortgage company, said early Tuesday it is exploring various strategic options, including raising additional capital, as much of its cash has been used up by margin calls and forced loan repurchases. Shares plunged 62%, dropping $7.06 to $4.34.

Accredited said it has met $190 million in margin calls this year, most of them in the last month. The company said it is seeking waivers on its credit lines and cutting costs through moves including layoffs.

"We believe that the downturn in the subprime market, and the likelihood that it will persist, sharply raises the liquidity risk," said Keefe Brutette & Woods analyst Bose George in a research note Tuesday morning.

Just what the market needed -- another subprime lender with problems. Let the heads roll - again.

Ugly Day In the Market

Wow -- what a sell-off. First, let's look at the charts. I should mention that my daily charts come from Quotetracker. I don't endorse or not endorse that software -- it's just where my charts come from .

Here are today's charts in the following order:

SPY, QQQQ, IWN

The markets first tumbled a bit after 11 EST. Notice the three really strong downward bars on strong volume. This indicates there were a ton of sellers and they were in complete control.

About 12:30 the IWNs sold-off. Remember the Russell 2000 have performed slightly better for the last few sessions, meaning there were more profits to book.

All the averages tumbled again at 1300 and the QQQQs and SPYs had a volume spike at this time. Again -- a ton of sellers enter the market and they are in complete control of all the action.

Notice how all the averages died at the end on extremely heavy volume. This was literally a, "Katy bar the door" moment in the market when everybody wanted to get out.

Also note the markets continued to trade down throughout the day and closed near session lows. These are all bearish signs. The continual downward trend indicates the market could not find a bottom during trading. Closing near a low, on a sell-off on very high volume indicates people were dumping shares. That means they are nervous about what news might come out tonight and tomorrow morning.

According to Briefing.com:

Here's a chart from CBS Marketwatch that shows the foreclosures:

In addition, the NYSE delisted New Century Financial which was the second largest subprime mortgage lender in the country until recently.

We also had a bad retail sales report, which indicates housing problems may be spilling over into other areas of the economy.

So, adding all of this up, we get a market that has concerns about the housing market, some general fear left-over from the most recent slide and overall concern the housing slowdown is seeping into other areas of the economy like consumer spending.

The bears are making their voices heard.

Here are today's charts in the following order:

SPY, QQQQ, IWN

The markets first tumbled a bit after 11 EST. Notice the three really strong downward bars on strong volume. This indicates there were a ton of sellers and they were in complete control.

About 12:30 the IWNs sold-off. Remember the Russell 2000 have performed slightly better for the last few sessions, meaning there were more profits to book.

All the averages tumbled again at 1300 and the QQQQs and SPYs had a volume spike at this time. Again -- a ton of sellers enter the market and they are in complete control of all the action.

Notice how all the averages died at the end on extremely heavy volume. This was literally a, "Katy bar the door" moment in the market when everybody wanted to get out.

Also note the markets continued to trade down throughout the day and closed near session lows. These are all bearish signs. The continual downward trend indicates the market could not find a bottom during trading. Closing near a low, on a sell-off on very high volume indicates people were dumping shares. That means they are nervous about what news might come out tonight and tomorrow morning.

According to Briefing.com:

If the problems in the subprime mortgage market have got you down, the Mortgage Bankers Association didn't do anything today to lift your spirits. If anything, it dampened them even further with a declaration that delinquencies among subprime borrowers hit 13.33% in the fourth quarter, which is the highest rate since the third quarter of 2002.

Here's a chart from CBS Marketwatch that shows the foreclosures:

In addition, the NYSE delisted New Century Financial which was the second largest subprime mortgage lender in the country until recently.

We also had a bad retail sales report, which indicates housing problems may be spilling over into other areas of the economy.

So, adding all of this up, we get a market that has concerns about the housing market, some general fear left-over from the most recent slide and overall concern the housing slowdown is seeping into other areas of the economy like consumer spending.

The bears are making their voices heard.

Late Mortgage Payments At 3-year High

Special thanks to Bonddad's wonderful girlfriend for this.

From MSNBC:

Let's look at those specifics.

1.) Late payments are at a 3.5 year high.

2.) New foreclosures are at a record high.

3.) The last time foreclosures were at this level was after a recession -- a period of lower economic activity. as the US economy is slowing, it's fair to say this level of foreclosures before a possible recession does not bode well.

From MSNBC:

Late mortgage payments shot up to a 3½-year high in the final quarter of last year and new foreclosures surged to a record high as borrowers with tarnished credit histories had trouble keeping up with their monthly payments.

The Mortgage Bankers Association, in its quarterly snapshot of the mortgage market released Tuesday, reported that the percentage of payments that were 30 or more days past due for all loans tracked jumped to 4.95 percent in the October-to-December quarter.

That marked a sharp rise from the third-quarter’s delinquency rate of 4.67 percent and was the worst showing since the spring of 2003, when the late-payment rate climbed to 4.97 percent.

....

The percentage of mortgages that started the foreclosure process in the final quarter of last year rose to 0.54 percent, a record high. The previous high, 0.50 percent, occurred in the second quarter of 2002 as the economy was recovering from the blows of the 2001 recession.

Delinquency and foreclosure rates were considerably higher for higher-risk “subprime” borrowers, especially those with adjustable-rate mortgages.

Let's look at those specifics.

1.) Late payments are at a 3.5 year high.

2.) New foreclosures are at a record high.

3.) The last time foreclosures were at this level was after a recession -- a period of lower economic activity. as the US economy is slowing, it's fair to say this level of foreclosures before a possible recession does not bode well.

Markets Tanking

As of this writing, the QQQQs and SPYs are down about 1% and the IWNs are down 1.75%. All of the press is blaming the subprime market.

Retail Sales Up .1%

From the Commerce Department:

Bloomberg adds more:

Are consumers finally starting to slow down their continual appetite for new stuff?

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $370.5 billion, an increase of 0.1 percent (±0.7%)* from the previous month and up 3.2 percent (±0.7%) from February 2006. Total sales for the December 2006 through February 2007 were up 3.7 percent (±0.5%) from the same period a year ago. The December 2006 to January 2007 percent change was unrevised from 0.0 percent (± 0.3%)*.

Retail trade sales were up 0.2 percent (±0.7%)* from January 2007 and were 3.1 percent (±0.8%) above last year. Nonstore retailers were up 9.1 percent (±4.5%) from February 2006 and sales of health and personal care stores were up 6.1 percent (±1.7%) from last year.

Bloomberg adds more:

Retail sales in the U.S. rose less than forecast last month as an increase in gasoline prices limited spending on other goods.

The 0.1 percent gain followed no change in the prior month, the Commerce Department said today in Washington. Sales excluding service-station receipts were unchanged as the return of colder weather discouraged shoppers.

The figures point to a gradual slowdown in consumer spending that Federal Reserve Chairman Ben S. Bernanke called a ``mainstay'' of the expansion. Fewer purchases, combined with the downturns in housing and manufacturing, make it less likely that growth will accelerate in coming months.

``Once we disentangle the effect of higher gasoline prices on service-station receipts, we see a modest amount of consumer spending,'' Ken Mayland, president of ClearView Economics LLC in Pepper Pike, Ohio, said before the report. ``It appears consumer spending is something short of healthy.''

Are consumers finally starting to slow down their continual appetite for new stuff?

Hiring Plans Diminish

From IBD:

While plans can always change, this is not good news on the employment front.

A net 18% of firms plan to add staff in Q2, according to Manpower's latest jobs survey. That's the lowest since early '04. Construction firms have slashed hiring plans. Factories and service firms also have cut back. It's the latest evidence of easing labor markets. Fri.'s Feb. job report showed the weakest hiring in 2 years. Jobless claims also have trended up.

While plans can always change, this is not good news on the employment front.

Subprime Problems Will Impact New Home Sales

From the WSJ:

Credit Suisse is the first company that predicted the rapid increase in the default rate of the subprime mortgage industry.

The rapid unraveling of the subprime-mortgage industry is stirring new concerns about the already weak housing market.

A report released yesterday by Credit Suisse analyst Ivy Zelman forecast that credit tightening for financially stretched borrowers will lead to a 20% drop in new-home sales in 2007, to about 890,000, as buyers find it more difficult to borrow for homes.

Coupled with a general waning in demand for housing and the exodus of speculators from the market, Ms. Zelman expects that credit tightening will cause housing starts to drop 35% to 45% through this year and into 2008 from their peak annual rate of 1.8 million units in January 2006.

Credit Suisse is the first company that predicted the rapid increase in the default rate of the subprime mortgage industry.

Anatomy of a Subprime Default

From the WSJ:

This is a standard part of the securitization industry. Here's how it generally works.

1.) Subprime company makes loan.

2.) Subprime company sells loan to larger bank.

3.) Larger bank pools loan with other, similar loans (same interest rate, same maturity etc....) and then sell pools to various investment groups (insurance companies, mutual funds etc...).

As part of step 2, the subprime originator agrees it will repurchase a loan under certain conditions, one of which is usually a specific delinquency rate.

When a large number of loans go into delinquency early, the larger banks can flood the subprime originator with repurchase requests. This can bankrupt the subprime originator which is exactly what is happening right now.

This is why there have been so many problems in the subprime originators for the last few months.

That's a a whole lot of money. Considering New Century relies on lines of credit from the same large investment banks to finance its operations, New Century is obviously in a world of hurt.

From a balance sheet perspective, this is a huge deal. Essentially, the owners/stockholders see their actual ownership interest wiped out overnight. Imagine if you were part owner of a company and you just woke up to discover your ownership interest -- which was pretty decent yesterday, is now worth nothing 24 hours later.

Loose credit standards are a prime culprit in the problems:

There's also a large amount of "whose left holding the bag" going on -- as in, who is being stuck with the loss.

Short version of all this -- it's a big damn mess.

Amid mounting defaults in the market for subprime mortgages, some big banks and mortgage companies are striking out in their efforts to wrest compensation from originators of those high-risk, high-return loans.

Led by HSBC Holdings PLC, banks and others are trying to force small mortgage lenders to buy back some of the same loans the banks eagerly bought in 2005 and 2006, by enforcing what the industry calls repurchase agreements. Squeezed by the onslaught of defaults, many originators are saying they can't afford to buy back their loans or are pursuing bankruptcy protection.

This is a standard part of the securitization industry. Here's how it generally works.

1.) Subprime company makes loan.

2.) Subprime company sells loan to larger bank.

3.) Larger bank pools loan with other, similar loans (same interest rate, same maturity etc....) and then sell pools to various investment groups (insurance companies, mutual funds etc...).

As part of step 2, the subprime originator agrees it will repurchase a loan under certain conditions, one of which is usually a specific delinquency rate.

Although the specifics vary from deal to deal, repurchase agreements obligate the mortgage originator, under some circumstances, to buy back a troubled loan sold to a bank or investor. That obligation sometimes kicks in if the borrower fails to make payments on the loan within the first few months or if there was fraud involved in obtaining the original mortgage. The total volume of mortgages nationwide that might meet those criteria isn't known, but such agreements cover billions of dollars in mortgages.

When a large number of loans go into delinquency early, the larger banks can flood the subprime originator with repurchase requests. This can bankrupt the subprime originator which is exactly what is happening right now.

This is why there have been so many problems in the subprime originators for the last few months.

New Century said yesterday that, starting last Wednesday, it had received a wave of default notices from its major Wall Street creditors, and may owe creditors a combined $8.4 billion for mortgage repurchases. It said if all its lenders demand repurchases, it can't afford to pay. That could force the company into bankruptcy proceedings, where it would join scores of others hurt by the industry meltdown.

That's a a whole lot of money. Considering New Century relies on lines of credit from the same large investment banks to finance its operations, New Century is obviously in a world of hurt.

Robert Napoli at Piper Jaffray said assuming a 20% loss rate on loans it is forced to buy back from its creditors, New Century "would have to absorb $1.6 billion of losses, essentially wiping out shareholders equity." As of Sept. 30, the company listed $25 billion in assets, about $23 billion in liabilities and $2 billion in shareholders' equity.

From a balance sheet perspective, this is a huge deal. Essentially, the owners/stockholders see their actual ownership interest wiped out overnight. Imagine if you were part owner of a company and you just woke up to discover your ownership interest -- which was pretty decent yesterday, is now worth nothing 24 hours later.

Loose credit standards are a prime culprit in the problems:

HSBC's borrowers included people who couldn't make their first mortgage payments as well as people who misrepresented their income or employment on their mortgage applications, interviews and HSBC's court filings show.

There's also a large amount of "whose left holding the bag" going on -- as in, who is being stuck with the loss.

When it is unable to claim its money or believes it will be unable to, HSBC must write off the loans. In 2006, the bank said the loan-impairment cost totaled $6.68 billion for its main U.S. consumer finance business. That was 34% higher than in 2005. The bank has said it may take two to three years to work through its problem loans.

HSBC's top finance chief acknowledges the difficulties in trying to enforce repurchase agreements. "It's proving quite difficult in the sense that many of the parties...don't have the wherewithal" to repurchase the loans, said HSBC Finance Director Douglas Flint.

Short version of all this -- it's a big damn mess.

Monday, March 12, 2007

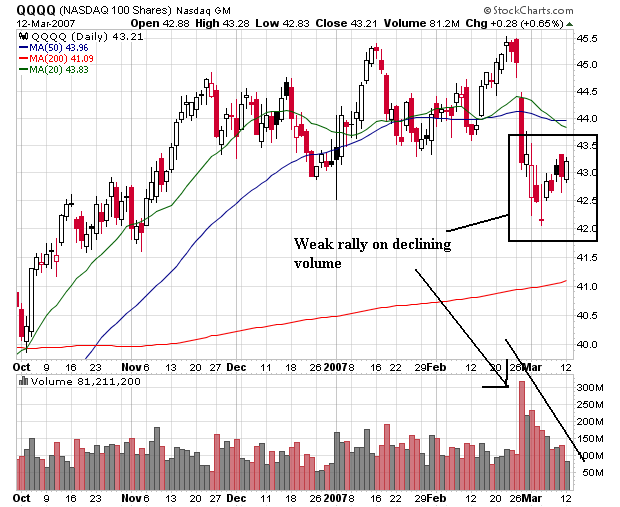

Market Overview

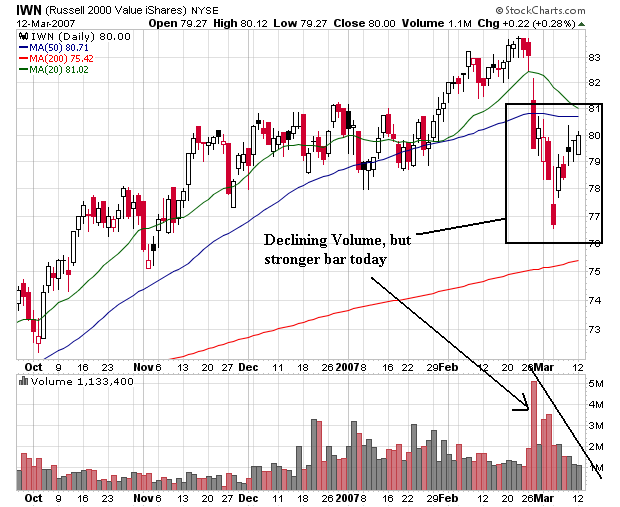

Here are the averages in the following order: SPY, QQQQ, IWN

All three averages are settling down in terms of volume, which has declined gradually from the selling peak a few weeks ago.

Notice all three averages have a somewhat weaker rally. All averages contain weaker candle bars -- bars with shorter bodies and longer shadows. Also note the rallies occurred on declining volume -- a bearish sign. However, because the markets are coming off of very high volume days, the declining volume may not have as strong a bearish implication.

With the IWNs note today's strong bar. There is no lower shadow and the market closed near its high. This is called a bullish engulfing pattern, and it is considered a bullish signal. While the volume total does not confirm it, the size of today's body may indicate traders are looking at small caps again.

It still looks to me like that averages are looking for direction. While all three are technically in an uptrend, the inner-dynamics of the uptrend just aren't that strong.

As with all TA -- the markets will make an ass of you whenever and wherever possible.

All three averages are settling down in terms of volume, which has declined gradually from the selling peak a few weeks ago.

Notice all three averages have a somewhat weaker rally. All averages contain weaker candle bars -- bars with shorter bodies and longer shadows. Also note the rallies occurred on declining volume -- a bearish sign. However, because the markets are coming off of very high volume days, the declining volume may not have as strong a bearish implication.

With the IWNs note today's strong bar. There is no lower shadow and the market closed near its high. This is called a bullish engulfing pattern, and it is considered a bullish signal. While the volume total does not confirm it, the size of today's body may indicate traders are looking at small caps again.

It still looks to me like that averages are looking for direction. While all three are technically in an uptrend, the inner-dynamics of the uptrend just aren't that strong.

As with all TA -- the markets will make an ass of you whenever and wherever possible.

The Markets Today

SPY: +.13%

QQQQ: +.54

IWN: +.21

Notice:

1.) All of the averages had an upward bias throughout the day.

2.) All three averages sold-off after their rally.

However --

The IWNs rallied back to close near their daily highs and the QQQQs rallied as well, although they closed off their peaks. Both averages rallied on increasing volume, which is bullish.

The SPYs rallied as well, although they were less than inspired in their trading.

All three averages showed a break-out, sell-off that tested certain levels followed by a rally. Those events are generally considered to be bullish.

QQQQ: +.54

IWN: +.21

Notice:

1.) All of the averages had an upward bias throughout the day.

2.) All three averages sold-off after their rally.

However --

The IWNs rallied back to close near their daily highs and the QQQQs rallied as well, although they closed off their peaks. Both averages rallied on increasing volume, which is bullish.

The SPYs rallied as well, although they were less than inspired in their trading.

All three averages showed a break-out, sell-off that tested certain levels followed by a rally. Those events are generally considered to be bullish.

More Subprime Problems

New Century Financial loses funding:

Bloomberg added this:

This is not a Mom and Pop storefront. It's the second largest subprime lender in the country. That should indicate the degree of problems the industry is facing right now.

New Century's woes deepened on Monday after the stricken subprime mortgage firm said its lenders are cutting off credit.

The NYESE delayed the opening of trading in New Century shares 9:30 a.m. Eastern, pending a news announcement, according to market sources.

The stock had dropped 56% to $1.42 in pre-market trades on the mortgage lender's latest credit woes.

The firm said in a filing with the Securities and Exchange Commission Monday that lenders under its short-term repurchase agreements and aggregation credit facilities had either discontinued their financing or notified the company they plan to do so.

Bloomberg added this:

New Century Financial Corp., the nation's second-biggest subprime lender, said today it doesn't have the cash to pay creditors who are demanding their money now, increasing speculation that the company will go bankrupt.

Shares of the Irvine, California-based company, already down 90 percent in 2007, lost half their remaining value in pre-market trading. New Century said in a federal filing it doesn't have funds to give to lenders including Morgan Stanley, Citigroup Inc. and Goldman Sachs Group Inc. The creditors want New Century to repurchase all outstanding mortgage loans they financed.

``They're one step closer to bankruptcy,'' said Bose George, an analyst at Keefe Bruyette & Woods in New York who rates the shares ``market perform.'' ``The only possibility for survival now is for someone, potentially an investment bank, to step in.'' Bose said a rescuer might provide more money in return for a large equity stake.

This is not a Mom and Pop storefront. It's the second largest subprime lender in the country. That should indicate the degree of problems the industry is facing right now.

Yield Curve Says Recession -- Still

From Bloomberg:

Here is something that I haven't written about in awhile -- the inverted yield curve. Short-term rates have responded to the Fed's interest rate hikes while the long-term part of the curve thinks inflation is at least in check for now. That means market participants think the economy is slowing and possibly moving into a recession.

The argument can be made that long-term rates are in fact responding to foreign direct investment in the US. However, this argument forgets to acknowledge that these investors wouldn't invest in US debt if inflation was an issue.

The short version is the yield curve is inverted, has been for some time and that is usually a sign of an approaching recession.

The probability the U.S. economy will shrink for two quarters has risen to 50 percent, according to a model created when Greenspan ran the Board of Governors of the Federal Reserve System. The formula is based on differences in yields on Treasuries.

The economy has gone into recession six of the seven times since 1960 that short-term interest rates topped longer-term bond yields, as they do now. The difference between three-month bills and benchmark 10-year notes is close to the widest since 2001. Investors say the so-called inverted yield curve is a sign the Fed will cut borrowing costs because the economy is decelerating.

Here is something that I haven't written about in awhile -- the inverted yield curve. Short-term rates have responded to the Fed's interest rate hikes while the long-term part of the curve thinks inflation is at least in check for now. That means market participants think the economy is slowing and possibly moving into a recession.

The argument can be made that long-term rates are in fact responding to foreign direct investment in the US. However, this argument forgets to acknowledge that these investors wouldn't invest in US debt if inflation was an issue.

The short version is the yield curve is inverted, has been for some time and that is usually a sign of an approaching recession.

China To Invest Reserves More Aggressively

From the WSJ:

How quickly the communists have become profit seeking capitalists...

Seriously, I don't know why it was taken them this long to more aggressively manage their foreign reserves. They do have over $1 trillion, after all.

Additionally, China has made a ton of deals over the last 5 years, essentially promising large amounts of cash for investment in return for access to raw materials. The South American landscape is littered with such deals.

China isn't the only country doing this. There is another Asian country who is also doing this, although I can't remember which one. Any help jostling my memory would be appreciated.

Minister of Finance Jin Renqing on Friday said the reserves will be split into two and managed differently. "'Normal' foreign-exchange reserves will continue to be managed by the State Administration of Foreign Exchange," Mr. Jin said. "Separately, a foreign-exchange investment company will be set up under the leadership of the State Council," he said, referring to China's executive branch.

He didn't say what portion of the reserves might be channeled through the new investment company or when it would start to operate. He also didn't specify whether the reserves might be spent to achieve nonfinancial goals. Some government officials in charge of energy and industry policy have called for using the funds to buy natural resources or key technologies.

"In carrying out the investment management of this foreign exchange, we will strive to achieve greater profits and benefits with the prerequisite of maintaining safety," Mr. Jin said.

How quickly the communists have become profit seeking capitalists...

Seriously, I don't know why it was taken them this long to more aggressively manage their foreign reserves. They do have over $1 trillion, after all.

Additionally, China has made a ton of deals over the last 5 years, essentially promising large amounts of cash for investment in return for access to raw materials. The South American landscape is littered with such deals.

China isn't the only country doing this. There is another Asian country who is also doing this, although I can't remember which one. Any help jostling my memory would be appreciated.

Sunday, March 11, 2007

Tougher Lending Standards May Increase Housing Problems

From Gannett:

As lenders tighten their standards higher risk borrowers who want to refinance their respective loans are facing problems. This will probably make the current housing market problem of high inventory a whole lot worse.

Since the start of the year, more lenders have been shutting their doors to people like Booker, just as those homeowners' interest rates are rising. They're slashing the "Bad credit? No problem" types of loan programs, known as subprime, that helped fuel the housing boom. And they're raising the bar for homeowners and first-time buyers to qualify for new loans.

The trend accelerated last week after federal regulators proposed stricter guidelines for banks that make subprime ARMs (adjustable-rate mortgages). The move followed Freddie Mac's decision to drastically raise the criteria for the subprime ARMs it would buy and to require better proof of a borrower's finances.

The industry is reacting to the waves of subprime borrowers who've defaulted on their ARMs in recent months. The tighter controls should help prevent future borrowers from getting in over their heads and protect them from predatory lenders. But the sudden shift in lending rules could also threaten the homeownership gains made by families since 2000, weaken the recovery of the housing market and potentially slow the economy.

As lenders tighten their standards higher risk borrowers who want to refinance their respective loans are facing problems. This will probably make the current housing market problem of high inventory a whole lot worse.

Sub-Prime Problems Moving Into Other Loan Areas

From CBS MarketWatch:

This was bound to happen -- it's not a matter of if, but when.

Notice the following points.

1.) The amount of these loans has increased from 2.1% of all loans in 2003 to 13.4% in 2006. That's a 6 fold increase. That indicates the degree of credit degradation that has occurred in the lending business during the housing bubble.

2.) The article goes on to state that Alt-A loans have absorbed some subprime loans. That means the subprime numbers being reported are too low; they are actually worse than reported. Not good.

3.) Financial companies make up the largest percentage of the S&P 500. That means the largest sector in that market average will be under increased selling pressure if these stories persist.

Problems in the subprime mortgage business may be spreading to other parts of the home loan market.

Losses are creeping up on so-called Alt-A loans, which are considered less risky than subprime mortgages, but may have lower credit quality than "prime" loans.

Alt-A loans were originally designed for borrowers with clean credit records, but with other issues that often meant they provided fewer documents or even no documents showing what they earned. These loans were attractive to mortgage investors because they offered higher yields than traditional "prime" home loans, but were underpinned by the cleaner credit records of the borrowers.

The popularity of Alt-A mortgages exploded in recent years. A record $400 billion of these loans were originated in 2006. They accounted for 13.4% of all mortgages offered last year, up from 2.1% in 2003, according to industry publisher Inside Mortgage Finance.

This was bound to happen -- it's not a matter of if, but when.

Notice the following points.

1.) The amount of these loans has increased from 2.1% of all loans in 2003 to 13.4% in 2006. That's a 6 fold increase. That indicates the degree of credit degradation that has occurred in the lending business during the housing bubble.

2.) The article goes on to state that Alt-A loans have absorbed some subprime loans. That means the subprime numbers being reported are too low; they are actually worse than reported. Not good.

3.) Financial companies make up the largest percentage of the S&P 500. That means the largest sector in that market average will be under increased selling pressure if these stories persist.

Current Subprime Problems = "Tip of A Wave"

From Bloomberg:

Depending on which news source you read, there are between $700 billion and $1 trillion of subprime loans that adjust this year. That means we have 9 more months of possible problems.

In addition, when a Fed official uses the phrase "tip of the iceberg" you know you've got some possible problems coming down the pike.

The nation's banks are just beginning to feel the pain of defaults on risky mortgages they made at low introductory rates when housing prices were soaring, U.S. Federal Reserve Governor Susan Bies said.

Bies, who has been the Fed's top banking policy official in her tenure at the U.S. central bank, said today banks are likely to see more missed payments and foreclosures as consumers with weak credit histories begin to face higher monthly mortgage payments.

``What's happening is the front end of this wave of teaser- rate loans that are coming into full pricing,'' Bies said at a risk-management forum in Charlotte, North Carolina. ``So what we're seeing in this narrow segment is the beginning of the wave. This is not the end, this is the beginning.''

Depending on which news source you read, there are between $700 billion and $1 trillion of subprime loans that adjust this year. That means we have 9 more months of possible problems.

In addition, when a Fed official uses the phrase "tip of the iceberg" you know you've got some possible problems coming down the pike.