Saturday, September 8, 2012

Weekly Indicators: long leading indicators positive, but manufacturing and employment are huge concerns edition

- by New Deal democrat

The big monthly news this week was yesterday's positive but lousy employment report, showing a miserable 96,000 jobs being added in August (but see Lee Adler's interesting analysis indicating that this was the best August report NSA in years, defeated by an unusually heavy seasonal adjustment downwards), and a decline in the unemployment rate to 8.1% driven entirely by a decline in the labor force (the reasons for which are hotly contested). Construction spending, both residential and commercial, was also down. The ISM manufacturing index showed slight contraction for the third straight month. Labor costs were revised downward. On the upside, the ISM services index showed expansion, and we had the best month of vehicle sales in over 4 years.

The high frequency weekly indicators which ought to show turns before they show up in monthly or quarterly data, however, were generally more positive, with a few exceptions, most especially gas prices, so let's start once again with those.

The energy choke collar remains engaged, but gasoline usage is holding up:

Gasoline prices rose yet again last week, up $.06 from $3.78 to $3.84. Gas prices have risen $0.48 since their early July bottom, and are now only $0.10 cheaper than at their highest point this spring.Oil prices per barrel ended close to unchanged for the week, only down $0.05 at $96.42.

Gasoline usage was positive on a YoY basis. For one week, it was 9177 M gallons vs. 8956 M a year ago, up +2.5%. The 4 week average at 9158 M vs. 9097 M one year ago, was also up +0.7%.

Employment related indicators were again mixed this week.

The Department of Labor reported that Initial jobless claims fell 9000 to 365,000 from the prior week's unrevised figure. The four week average rose 1,000 to 371,250, about 2.7% above its post-recession low. If higher oil prices are again acting as a governor preventing fast economic growth, then this number, unforturnately, should continue to rise in coming weeks, although there is no persuasive impact yet.

The Daily Treasury Statement showed that for August 2012, $145.5 B was collected vs. $142.5 B a year ago, a $3 B or 2.1% increase. For the last 20 days ending on Thursday September 6, $131.4 B was collected vs. $125.7 B for the comparable period in 2011, a solid gain of $5.7 B or +4.3%.

The American Staffing Association Index remained stalled at 93. This index was generally flat during the second quarter at 93 +/-1, and for it to be positive should have continued to rise from that level after its July 4 seasonal decline. That it has not done so is a real concern, as it is still performing worse than it did in 2007 and 2011.

Same Store Sales were positive, while Gallup consumer spending was flat:

The ICSC reported that same store sales for the week ending August 25 gained +0.4% w/w, and rose +3.7% YoY. Johnson Redbook reported a solid 2.5% YoY gain. The 14 day average of Gallup daily consumer spending as of September 6 was $68, only up $1 over last year's $67 for this period. Gallup's comparison plunged at the very end of August, but has rebounded somewhat since, after 5 strong weeks.

Bond yields fell as did credit spreads:

Weekly BAA commercial bond rates declined .13% to 4.83%. Yields on 10 year treasury bonds only fell .11% to 1.63%. The credit spread between the two narrowed to 3.20%, which is closer to its 52 week minimum than maximum, and continues to improve from several months ago.

Housing reports were modestly positive:

The Mortgage Bankers' Association reported that the seasonally adjusted Purchase Index fell -0.8% from the prior week, but is up 1% YoY. Generally these are in the middle part of their 2+ year range. The Refinance Index fell -3% for the week due to higher mortgage rates, to a 4 month low.

The Federal Reserve Bank's weekly H8 report of real estate loans this week rose 7 to 3519. The YoY comparison rose to +1.2%, which is also the seasonally adjusted bottom.

YoY weekly median asking house prices from 54 metropolitan areas at Housing Tracker were up + 2.0% from a year ago. YoY asking prices have been positive for 9 months now.

Money supply remains generally positive despite now being fully compared with the inflow tsunami of one year ago:

M1 rose +0.3% last week, and was up a slight +0.2% month over month. Its YoY growth rate declined slightly to +9.5%, as comparisons with last year's tsunami of incoming cash are in full progress. As a result, Real M1 fell to +8.1%. YoY. M2 also increased +0.3% for the week, and was up 0.2% month/month. Its YoY growth rate declined to +6.1%, so Real M2 grew at +4.7%. The growth rate for real money supply has slowed significantly, but is still positive even though the tsunami of cash arriving from Europe last summer has disappeared from the comparisons.

Rail traffic was positive ex-coal while its diffusion index remained steady:

The American Association of Railroads reported a +0.9% increase in total traffic YoY, or +4,800 cars. Non-intermodal rail carloads were off a substantial -3.4% YoY or -10,300, once again entirely due to coal hauling which was off -12,700. Negative comparisons remained at 10 types of carloads. Intermodal traffic was up 15,200 or +6.5% YoY.

Turning now to high frequency indicators for the global economy:

The TED spread declined to a new 52 week low of 0.31. The one month LIBOR declined to 0.228, setting another new 52 week low. It remains well below its 2010 peak and is lower than at all time during the last 3 years with the exception of about 5 months. Even with the recent scandal surrounding LIBOR, it is probably still useful in terms of whether it is rising or falling.

The Baltic Dry Index fell yet again from 703 to 669, setting a new 52 week low. The Harpex Shipping Index fell 3 from 396 to 393, and remains only 18 above its February low.

Finally, the JoC ECRI industrial commodities index rose once again from 120.61 to 122.23, although it is still down 10% YoY. While it remains a strong sign that the globe taken as a whole has slumped, it is improved sharply over the last month.

What emerges from the updated numbers at this point is a sharp bifurcation. Every single manufacturing number is either showing contraction or close thereto. Manufacturing employment and work week have also contracted. The global picture remains gloomy, although the JoC ECRI increases and the continuing declines in the TED spread and LIBOR suggest that may be bottoming.

I am very concerned that we will get an actual loss of jobs at some point by the end of the year. Should that happen in the next two months, it will probably dominate the eve of the US presidential election. Temp services have declined, wages have declined, and short term unemployment (a leading indicator) is at recession inception levels. Gasoline prices may be impacting consumers again, and consumer spending is a short leading indicator for employment.

At the same time almost all of the housing indicators continue to show improvement, we just sold more cars than at any point in the last 4+ years. money supply continues to be positive, bond yields are low, and credit spreads are contracting. The stock indexes just made new multi-year highs. These are all long or medium term leading indicators, and suggest that the US economy's prospects generally remain good.

On balance, I remain very cautiously optimistic, but continuing increases in gasoline prices are making me more concerned about the end of this year and the first half of next year.

Have a good weekend.

Friday, September 7, 2012

Three telling graphs from the employment report

- by New Deal democrat

The employment report is the ultimate coincident indicator. Along with income, the status of jobs are what says YOU ARE HERE to the vast majority of Americans. Here are three signposts from the jobs report.

First of all, here is the YoY% change in jobs growth. Note that it has generally stagnated between 1.3% and 1.4% for the last 4 months.

Typically under a correlary to "Okun's law", which posits a linear relationship between GDP and jobs and the unemployment rate, it takes about 2% or so positive growth in GDP to generate growth in jobs over the rate of population growth. We've had that 2% YoY GDP for about a year now, and the rate of job growth YoY has neither been improving nor deteriorating significantly.

Secondly, the rate of initial jobless claims being made continues to lead the unemployment rate by 1 or 2 months. It suggess that we probably won't see any further improvement in the unemployment rate between now and election day:

Finally, here is an update on the scatter graph I posted yesterday, showing the relationship between initial jobless claims (left scale) and job growth (bottom scale). Today's number is shown in orange:

This shows that we continue to have poor hiring for a given level of firing compared with earlier in this recovery. That this new trend has persisted for 6 months suggests that we are moving closer to a new recession.

It's Another Mediocre Employment Report

Oh joyous day -- the BLS has provided us with yet another reminder of how tepid the current jobs recovery is.

There are some important internal numbers that are concerning:

Hourly earnings edged down -- another bad sign.

And we see a net reduction in jobs created over the last two months.

At this point, these reports are nothing more than cruel jokes on the economic pundits.

-------------------------

NDD here, seconding everything Bonddad said above, with a few additional comments:

In addition to the leading indicator of the manufacturing workweek shrinking, manufacturing jobs also declined 16,000, some but not all of which was due to auto manufacturers laying off fewer workers in July and so recalling fewer in August. Temporary jobs declined 4900.

Another leading indicator, the number of people unemployed from zero to 5 weeks, increased by 133,000. It is 301,000 over its level in April. This is a level that in the past has frequently been associated with the onset of recession.

The diffusion index of employment growth declined to 50.2%, indicating that as many industries are shedding workers as are adding them.

The household survey reported an actual loss of -119,000 jobs.

Private jobs created were +103,000. Government shed -7000 jobs.

There were really only two bright spots. Aggregate hours worked increased 0.1% to 96.0 (2007=100).

Unemployment declined to 8.1%, and the broader U-6 unemployment rate declined to 14.7%. Even this isn't as good as it first sounds, as the decline was because 368,000 people left the labor force (recall that there is a heated debate as to how much of this is people giving up vs. Boomers retiring). Both the participation rate and the employment to population ratio remained punk.

This is the kind of report that I would expect to see a few months before the onset of recession. That June and July were both revised down is another trend I would expect to see on the cusp of a recession. That hiring was so abysmal even in the relative absence of firing as measured by initial jobless claims is yet another red flag.

I'd probably go a little further than Bonddad and call this not just mediocre, but miserable - as miserable as a report could be and still have a positive topline number.

Total nonfarm payroll employment rose by 96,000 in August, and the unemployment rate edged down to 8.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment increased in food services and drinking places, in professional and technical services, and in health care.Yes, we're growing, but just barely. It's certainly not enough to get excited about.

There are some important internal numbers that are concerning:

The average workweek for all employees on private nonfarm payrolls was unchanged at 34.4 hours in August. The manufacturing workweek declined by 0.2 hour to 40.5 hours, and factory overtime was unchanged at 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 33.7 hours. (See tables B-2 and B-7.)

In August, average hourly earnings for all employees on private nonfarm payrolls edged down by 1 cent to $23.52. Over the past 12 months, average hourly earnings rose by 1.7 percent. In August, average hourly earnings of private-sector production and nonsupervisory employees edged down by 1 cent to $19.75. (See tables B-3 and B-8.)

The change in total nonfarm payroll employment for June was revised from +64,000 to +45,000, and the change for July was revised from +163,000 to +141,000.The workweek was unchanged and down -- indicating that there is still excess capacity that we're not using. That's not good.

Hourly earnings edged down -- another bad sign.

And we see a net reduction in jobs created over the last two months.

At this point, these reports are nothing more than cruel jokes on the economic pundits.

-------------------------

NDD here, seconding everything Bonddad said above, with a few additional comments:

In addition to the leading indicator of the manufacturing workweek shrinking, manufacturing jobs also declined 16,000, some but not all of which was due to auto manufacturers laying off fewer workers in July and so recalling fewer in August. Temporary jobs declined 4900.

Another leading indicator, the number of people unemployed from zero to 5 weeks, increased by 133,000. It is 301,000 over its level in April. This is a level that in the past has frequently been associated with the onset of recession.

The diffusion index of employment growth declined to 50.2%, indicating that as many industries are shedding workers as are adding them.

The household survey reported an actual loss of -119,000 jobs.

Private jobs created were +103,000. Government shed -7000 jobs.

There were really only two bright spots. Aggregate hours worked increased 0.1% to 96.0 (2007=100).

Unemployment declined to 8.1%, and the broader U-6 unemployment rate declined to 14.7%. Even this isn't as good as it first sounds, as the decline was because 368,000 people left the labor force (recall that there is a heated debate as to how much of this is people giving up vs. Boomers retiring). Both the participation rate and the employment to population ratio remained punk.

This is the kind of report that I would expect to see a few months before the onset of recession. That June and July were both revised down is another trend I would expect to see on the cusp of a recession. That hiring was so abysmal even in the relative absence of firing as measured by initial jobless claims is yet another red flag.

I'd probably go a little further than Bonddad and call this not just mediocre, but miserable - as miserable as a report could be and still have a positive topline number.

Morning Market Analysis

Yesterday, stocks rallied hard. The top chart shows the 5 minute chart, where we see stocks rallying until around noon and then trading sideways for the rest of the day. The lower chart shows the daily chart, where prices rallied strongly on decent volume and moved through key support levels. Ideally, we'd like to see prices follow-through tomorrow with another strong day on high volume.

The two lower charts show the IWMs (top chart) and QQQs (lower chart) confirming the breakout of the SPYs.

The good news is the Italian market (top chart) and Spanish market (bottom chart) also broke out, indicating traders think the EUs bond buying program will greatly aid these two struggling economies.

Thursday, September 6, 2012

The Oil choke collar isn't affecting employment yet

- by New Deal democrat

The price of gasoline, at $3.84 a gallon as of this past Monday, is now only $0.10 less than it was at its spring peak, and less than $0.30 from its all time record high. With the Oil choke collar surprisingly engaged in late summer, we have a reak time test as to whether the weak spring/strong autumn employment reports are due to recession-induced distortions of seasonality alone, or whether we are actually seeing the Oil choke collar in action.

For now, my hypothesis that it is actually the Oil choke collar manifesting itself appears, well, wrong.

First, let's look at the absolute levels as gas prices (left scale) since January 2011 vs. initial jobless claims (right scale):

We can see the three nearly identical peaks of gas prices (blue) vs. the generally declining initial claims, with bumps up in springtime of both years -- several months after the price of gas takes off. In the last month, initial claims have also risen slightly. So far, it looks like my hypothesis could be right.

But look closer and you'll see that in 2011 there was also a small but noticeable rise in August and September, before a further decline asserted itself.

So let's look at the data another way. Karl Smith of Modeled Behavior has noted that initial claims have declined at a remarkably steady YoY rate for the last several years, suggesting that the alleged seasonal distortions completely disappear into the deeper trend once we look YoY. So here are the YoY% changes in gasoline prices and initial jobless claims (on the same left scale) over the same period as the first graph:

Now we can see that there has been a big change in the YoY price of gasoline over the last 18 months, but the downtrend in initial jobless claims has been remarkably stable within the -5% to -15% range, even including the slight increase during the last month.

Unless we start to see initial jobless claims rise to the level of 390,000 or so in the next 4 to 6 weeks, I'll have to conclude that the Oil choke collar hypothesis for explaining the apparent seasonal distortions in job numbers is busted.

If that happens because the economic news is better than I thought it would be, though, you may consider me happy to be wrong.

Initial claims and jobs: tomorrow's report should reveal the trend

- by New Deal democrat

Initial jobless claims averaged 371,000 per week in August. That's slightly higher than February, March, and July, but lower than every other month in the last 4 years. If this were six months ago, I would have estimated that the economy added about 250,000 jobs during the month. Not so ever since the hugely disappointing March payrolls report signalled a period of weakness.

Here's an update of the scattergraph of the monthly average of initial jobless claims (left scale) and the number of private jobs added that month (bottom scale) since jobless claims peaked in March 2009 during the recession. The last 5 months of relatively poor payroll reports are shown in red:

March and July, both of which averaged fewer layoffs than August, averaged 161,000 job growth, which has marked a break in the trend for the worse. April, May, and June, which featured higher jobless claims than August, averaged 125,000 jobs.

So, while there is a huge margin for error in any jobs report, and substantial revisions are common, where tomorrow's report lands will tell us a lot about the trend. A report closer to February's excellent number means that strength is re-asserting itself. A report between 100,000 and 200,000 will keep us in the subpar trend we have seen the last 5 months. A number under 100,000 puts us close to recessionary territory.

And the price of gasoline is rising. More on that later today.

Morning Market Analysis

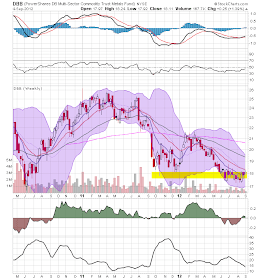

The transport ETF has been trading between 88 and 94 for the last three months. More importantly, prices are now at the lower end of the trading range while also being below the 200 day EMA. Prices are weak and momentum is dropping. This chart does not bode well for the overall market as a whole.

The homebuilding ETF, while still rallying, has lost some of its upward momentum. For the last three weeks, the index has printed three small candles. However, the underlying technicals are still strong -- momentum and the CMF are rising, and the EMAs are all moving higher. But a big negative is the declining volume, indicating that interest in the rally is waning for now.

So far this week, the Chinese ETF is trading below its lower support. This could mean that traders have given up on a possible stimulus from the central government in China and are selling shares.

The Indian market is also right at support. A trend break here would make the next logical target the multi-year lows.

The German market (top chart) and the French market (bottom chart) are both still in an uptrend. However, notice that both also have declining MACDs and EMAs that are becoming more horizontal in their orientation. Also note that prices have been trading sideways with a slight downward bias for the last two weeks.

Wednesday, September 5, 2012

A study in contrasts: housing, cars, and manufacturing

- by New Deal democrat

Reports on the economy from August started out with a contradictory bang yesterday, as the ISM manufacturing index showed a tiny contraction for the third month in a row, while motor vehicle sales set a post-recession record. The contrast between what is potentially a new global recession vs. improvement in the domestic US economy seems stark.

To repeat a point I've made many times before, based on research conducted by Prof. Edaward Leamer, typically the economy is led (by well over a year) by housing. It usually peaks 5 or 6 quarters before a recession begins. After housing turns, next comes durable goods, especially motor vehicles, which peak 6 to 12 months before the recession begins.

That was certainly the case going into the 2007-09 great recession, but the recovery was not led by housing, which bottomed only a few months before the end of the recession, and went more or less sideways for going on 2 years thereafter. Instead, the recovery was led by manufacturing and exports, which boomed. The ISM manufacturing index improved to readings that with the exception of one year, it had not seen since the 1990s.

This year the situation has reversed. First of all, here's the most recent update on housing permits:

I focus on housing permits because what is crucial for the economy is the amount of new housing stock, and secondarily home improvements, added to what exists. New houses employ construction workers, suppliers, landscapers, and after the housing is bought, appliances, furniture, window and door treatments, decks, patios, pools, trees, shrubs, and gardens are added over time. For the same reason, it's not so much the amount of permits themselves, but their improvement over time which is critical. The approximately 200,000 additional permits added over the last year in past experience has typically been associated with very strong GDP growth on the order of 4%.

Similarly, motor vehicle sales typically peak more than 2 quarters before the onset of a recession. Here's the data (averaged quarterly) from 1976 to 1992 (note sales never totally recovered following the 1980 recession):

And here it is from 1999 to through the second quarter of this year:

Not only were August sales the strongest in over 4 years, but the last 3 months as an average set a new post-recession record as well:

(courtesy Calculated Risk)

In short, if Leamer's business cycle order holds true now, we're nowhere near the onset of a new recession.

But if the housing recovery is finally underway, the export-led manufacturing boom which brought us out the the recession in 2009 has completely stalled, with three months in a row with readings slightly under 50, meaning ever so slight contraction. But the record here is more mixed. Recessions have started without the ISM manufacturing index slipping below 50, but more frequently the index has been well below 50 for a number of months before the recession began. In the last 25 years alone, the ISM index has dipped below 50 nine times, 4 of those times substantially, without a recession ensuing:

Similarly, while of the 13 times this index dropped below 50 from 1948 to 1983, a rescession followed 8 times, while 5 times it did not.

Manufacturing appears to be reacting to the global slowdown or contraction. Meanwhile, the US consumer is confident enought to be buying new houses and cars. In this tug of war, my bet is on the indefagitable American consumer. In that regard, August real retail sales, PCEs, and final business sales will tell us which side is stronger for now.

Supply Side v. Keynes, Pt. II: Our Real Problem Is Lack Of Demand

Consider the following from Keynes' General Theory:

But this, I have to point out, should not have led us to overlook the fact that the demand arising out of the consumption and investment of one individual is the source of the incomes of other individuals, so that incomes in general are not independent, quite the contrary, of the disposition of individuals to spend and invest; and since in turn the readiness of individuals to spend and invest depends on their incomes, a relationship is set up between aggregate savings and aggregate investment which can be very easily shown, beyond any possibility of reasonable dispute, to be one of exact and necessary equality. Rightly regarded this is a banale conclusion. But it sets in motion a train of thought from which more substantial matters follow. It is shown that, generally speaking, the actual level of output and employment depends, not on the capacity to produce or on the pre-existing level of incomes, but on the current decisions to produce which depend in turn on current decisions to invest and on present expectations of current and prospective consumption. Moreover, as soon as we know the propensity to consume and to save (as I call it), that is to say the result for the community as a whole of the individual psychological inclinations as to how to dispose of given incomes, we can calculate what level of incomes, and therefore what level of output and employment, is in profit-equilibrium with a given level of new investment; out of which develops the doctrine of the Multiplier. Or again, it becomes evident that an increased propensity to save will ceteris paribus contract incomes and output; whilst an increased inducement to invest will expand them. We are thus able to analyse the factors which determine the income and output of the system as a whole;—we have, in the most exact sense, a theory of employment. Conclusions emerge from this reasoning which are particularly relevant to the problems of public finance and public policy generally and of the trade cycle.

The emboldened lines are a key statement which illustrate why Say's law -- and supply side economics -- are the incorrect script for today's situation.

First, as I showed yesterday, the US has already implemented supply-side policies. We're already taxed at a very low rate relative to GDP. As a result, corporate profits and cash are already near all-time absolute highs. And investment has already returned to pre-recession levels. Under basic supply side doctrine, the creation and implementation of this overall environment should lead to more demand -- that is, supply should be creating some type of demand.

But, that in fact is not happening. Instead, demand has been lackluster. Consider this chart:

Above is a chart of real personal consumption expenditures on a "percentage change from last year basis." I've drawn a long black line from the current level all the way back to the beginning of the data series. In addition, I've boxed the usual levels associated with a recovery for the same time period. Notice that the usual year over year percentage change in PCEs is actually far higher than the current level. While we did see a nice bump at the beginning of the current recovery, that can also be explained as a simply reaction from a historically and abnormally pronounced collapse following the 2008 financial crisis.

The bottom line of the above data is that demand is very low by historical measures. And the reason is we're in the middle of a debt-deflation recovery, where people are just as likely to pay-down debt as purchase a new good or service. That means there is traditionally lower level of demand. As such, there isn't as strong a reason to invest in new production or capacity.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 306-311). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 299-306). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 297-299). Classics-Unbound. Kindle Edition.

But this, I have to point out, should not have led us to overlook the fact that the demand arising out of the consumption and investment of one individual is the source of the incomes of other individuals, so that incomes in general are not independent, quite the contrary, of the disposition of individuals to spend and invest; and since in turn the readiness of individuals to spend and invest depends on their incomes, a relationship is set up between aggregate savings and aggregate investment which can be very easily shown, beyond any possibility of reasonable dispute, to be one of exact and necessary equality. Rightly regarded this is a banale conclusion. But it sets in motion a train of thought from which more substantial matters follow. It is shown that, generally speaking, the actual level of output and employment depends, not on the capacity to produce or on the pre-existing level of incomes, but on the current decisions to produce which depend in turn on current decisions to invest and on present expectations of current and prospective consumption. Moreover, as soon as we know the propensity to consume and to save (as I call it), that is to say the result for the community as a whole of the individual psychological inclinations as to how to dispose of given incomes, we can calculate what level of incomes, and therefore what level of output and employment, is in profit-equilibrium with a given level of new investment; out of which develops the doctrine of the Multiplier. Or again, it becomes evident that an increased propensity to save will ceteris paribus contract incomes and output; whilst an increased inducement to invest will expand them. We are thus able to analyse the factors which determine the income and output of the system as a whole;—we have, in the most exact sense, a theory of employment. Conclusions emerge from this reasoning which are particularly relevant to the problems of public finance and public policy generally and of the trade cycle.

The emboldened lines are a key statement which illustrate why Say's law -- and supply side economics -- are the incorrect script for today's situation.

First, as I showed yesterday, the US has already implemented supply-side policies. We're already taxed at a very low rate relative to GDP. As a result, corporate profits and cash are already near all-time absolute highs. And investment has already returned to pre-recession levels. Under basic supply side doctrine, the creation and implementation of this overall environment should lead to more demand -- that is, supply should be creating some type of demand.

But, that in fact is not happening. Instead, demand has been lackluster. Consider this chart:

Above is a chart of real personal consumption expenditures on a "percentage change from last year basis." I've drawn a long black line from the current level all the way back to the beginning of the data series. In addition, I've boxed the usual levels associated with a recovery for the same time period. Notice that the usual year over year percentage change in PCEs is actually far higher than the current level. While we did see a nice bump at the beginning of the current recovery, that can also be explained as a simply reaction from a historically and abnormally pronounced collapse following the 2008 financial crisis.

The bottom line of the above data is that demand is very low by historical measures. And the reason is we're in the middle of a debt-deflation recovery, where people are just as likely to pay-down debt as purchase a new good or service. That means there is traditionally lower level of demand. As such, there isn't as strong a reason to invest in new production or capacity.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 306-311). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 299-306). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 297-299). Classics-Unbound. Kindle Edition.

Morning Market Analysis

The transport ETF has been trading between 88 and 94 for the last three months. More importantly, prices are now at the lower end of the trading range while also being below the 200 day EMA. Prices are weak and momentum is dropping. This chart does not bode well for the overall market as a whole.

The homebuilding ETF, while still rallying, has lost some of its upward momentum. For the last three weeks, the index has printed three small candles. However, the underlying technicals are still strong -- momentum and the CMF are rising, and the EMAs are all moving higher. But a big negative is the declining volume, indicating that interest in the rally is waning for now.

So far this week, the Chinese ETF is trading below its lower support. This could mean that traders have given up on a possible stimulus from the central government in China and are selling shares.

The Indian market is also right at support. A trend break here would make the next logical target the multi-year lows.

The German market (top chart) and the French market (bottom chart) are both still in an uptrend. However, notice that both also have declining MACDs and EMAs that are becoming more horizontal in their orientation. Also note that prices have been trading sideways with a slight downward bias for the last two weeks.

Morning Market Analysis

GLD has broken through resistance around the 158 area, rallied, sold-off in a downward sloping penant pattern to the 10 day EMA and moved higher again. Note the bullish EMA picture and rising CMF/MACD.

The weekly chart confirms the breakout with prices moving through downward sloping resistance. Also note the bullish CMF and MACD reading.

The big reason for the upward move is the Fed's statement that more easing was probably on the way. This led people to buy gold out of inflationary concerns.

However, unlike gold, the rest of the industrial metals complex is stuck at two-year lows. Recent negative readings from the manufacturing complex don't help this situation at all.

The dollar has moved below both the 200 day EMA and lower bands of the Mid-May late August trading range. Note the deterioration in the EMA picture; the shorter EMAs (10, 20 and 50 days) are moving lower and the shorter EMAs are below the longer. Also notice the very weak and declining MACD picture.

The Australian dollar -- which had been rallying since early June -- broke through support yesterday. The reason is China's continued manufacturing slowdown which will negatively impact Australia's economy.

Tuesday, September 4, 2012

Bonddad Linkfest

- Obama campaign deals with the "are you better off now" problem (WaPo)

- Corporate bond sales set record in August (Business Week)

- OECD inflation falls for fifth straight month (Marketwatch)

- RBA keeps rates unchanged (RBA)

- Gold prices hit 5 month high (Marketwatch)

- Chinese manufacturing continues contraction (Markit)

- EU manufacturing still contracting (Markit)

- UK manufacturing eases contraction (Market)

- Britain's Paul Ryan (Krugman)

- Don't expect a recovery anytime soon (Free Exchange)

Supply Side Verses Keynes, Pt, I; Supply Side's Failure In the Current Economy

This week I wanted to focus on a deeper issue, which is the classic economic argument of Say v. Keynes regarding the economy. Jean-Baptiste Say was one of whom I call "first macro economists." He -- along with Adam Smith, John Stuart Mill and a few others -- were the first to comprehensively write about "political economy," which was the first attempt to categorize and explain how the macro level economy was put together and functioned. The works of all three are very interesting reads as there is a fair amount of overlap regarding what they are discussing.

But Say is often credited with a theory that "supply creates its own demand." Say in fact never said this, but it could be implied from his 1803 work A Treatise on Political Economy which is organized into three Books: the Production of Wealth, the Distribution of Wealth and The Consumption of Wealth. Within his writing is the concept that in process of production (creating supply) money is spent on rent, interest, labor and raw materials. It is in the payment of these fees that the concept of "supply creating its own demand" comes into play. The central idea is that in the process of creating goods, the money spent will create a level of demand within the economy. Again, Say never in fact says this directly, but many have inferred it from his writing.

The primary critique of this idea came from Keynes in his work The General Theory of Employment, Interest and Money. In the Introduction to the French edition, Keynes makes the following points:

I believe that economics everywhere up to recent times has been dominated, much more than has been understood, by the doctrines associated with the name of J.-B. Say. It is true that his 'law of markets' has been long abandoned by most economists; but they have not extricated themselves from his basic assumptions and particularly from his fallacy that demand is created by supply. Say was implicitly assuming that the economic system was always operating up to its full capacity, so that a new activity was always in substitution for, and never in addition to, some other activity. Nearly all subsequent economic theory has depended on, in the sense that it has required, this same assumption. Yet a theory so based is clearly incompetent to tackle the problems of unemployment and of the trade cycle. Perhaps I can best express to French readers what I claim for this book by saying that in the theory of production it is a final break-away from the doctrines of J.-B. Say and that in the theory of interest it is a return to the doctrines of Montesquieu.

In Says defense, I don't think he was attempting to talk about the business cycle. Nor was there much mention of overall economic activity and how that would play into Say's overall theories and explanations. Say was really attempting to simply explain what he saw as the macro-level economy and how it functioned -- which was the central theme of most economists writing around Say's time. Put a different way, I believe that the early macro-econoimsts' work reflects the state of the discipline at that time; they had figured out there was this thing called an "economy" and were trying to learn about all it's various pieces. However, I do believe that Keynes was right in the implication many took from Say's overall works, which is that in creating an environment wherein supply is allowed to form and proliferate with as little interference as possible, demand naturally follows.

I mention the above debate to highlight the fact that in our present situation, we're already trying these ideas associated with supply side economics (or trying to increase supply) with no real success.

Corporate and personal taxes as a percent of GDP are already near 60 year lows. The theory of low taxation is that it will put more money in the pockets of consumers and businesses, who will in turn spend it. In addition, a low level of taxation is supposed to encourage the formation of businesses. These have had the desired result.

Non-financial corporate business is already swimming in cash. And

Corporate profits after tax are already near highs. In short, balance sheets have already increased. Finally,

Equipment and software investment (read, business investment) has already rebounded.

In short, supply side (read, Say's policies) are already in place. But Say's law of "supply creates its own demand" isn't working as advertised.

The reason it's not working is that monetary velocity is incredibly low:

The above charts tell us that people are hoarding cash rather than spending it.

Ultimately, what's going on here? The real answer is that in the middle of a debt deflation recovery, people hoard cash. The entire process is explained by Irving Fisher in his paper, "The Debt Deflation Theory of Great Depressions." However, here is the essence of his writing:

(1) Debt liquidation leads to distress setting and to (2) Contraction of deposit currency, as bank loans are paid off, and to a slowing down of velocity of circulation. This contraction of deposits and of their velocity, precipitated by distress selling, causes (3) A fall in the level of prices, in other words, a swelling of the dollar. Assuming, as above stated, that this fall of prices is not interfered with by reflation or otherwise, there must be (4) A still greater fall in the net worths of business, precipitating bankruptcies and (5) A like fall in profits, which in a " capitalistic," that is, a private-profit society, leads the concerns which are running at a loss to make (6) A reduction in output, in trade and in employment of labor. These losses, bankruptcies, and unemployment, lead to (7) Pessimism and loss of confidence, which in turn lead to (8) Hoarding and slowing down still more the velocity of circulation. The above eight changes cause (9) Complicated disturbances in the rates of interest, in particular, a fall in the nominal, or money, rates and a rise in the real, or commodity, rates of interest. Evidently debt and deflation go far toward explaining a great mass of phenomena in a very simple logical way.

Note that the economy is through the worst parts of the above cycle of events. However, now the economy is dealing with a slowing macro level environment from the EU and China, leading to concern and a "freezing" of activity.

The bottom line is that -- as Keynes correctly noted -- the policies outlined by adherents to Says law are ineffective in dealing with a period when employment of resources is below full potential.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 4350-4355). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 4337-4350). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 4336-4337). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Location 341). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 334-341). Classics-Unbound. Kindle Edition.

But Say is often credited with a theory that "supply creates its own demand." Say in fact never said this, but it could be implied from his 1803 work A Treatise on Political Economy which is organized into three Books: the Production of Wealth, the Distribution of Wealth and The Consumption of Wealth. Within his writing is the concept that in process of production (creating supply) money is spent on rent, interest, labor and raw materials. It is in the payment of these fees that the concept of "supply creating its own demand" comes into play. The central idea is that in the process of creating goods, the money spent will create a level of demand within the economy. Again, Say never in fact says this directly, but many have inferred it from his writing.

The primary critique of this idea came from Keynes in his work The General Theory of Employment, Interest and Money. In the Introduction to the French edition, Keynes makes the following points:

I believe that economics everywhere up to recent times has been dominated, much more than has been understood, by the doctrines associated with the name of J.-B. Say. It is true that his 'law of markets' has been long abandoned by most economists; but they have not extricated themselves from his basic assumptions and particularly from his fallacy that demand is created by supply. Say was implicitly assuming that the economic system was always operating up to its full capacity, so that a new activity was always in substitution for, and never in addition to, some other activity. Nearly all subsequent economic theory has depended on, in the sense that it has required, this same assumption. Yet a theory so based is clearly incompetent to tackle the problems of unemployment and of the trade cycle. Perhaps I can best express to French readers what I claim for this book by saying that in the theory of production it is a final break-away from the doctrines of J.-B. Say and that in the theory of interest it is a return to the doctrines of Montesquieu.

In Says defense, I don't think he was attempting to talk about the business cycle. Nor was there much mention of overall economic activity and how that would play into Say's overall theories and explanations. Say was really attempting to simply explain what he saw as the macro-level economy and how it functioned -- which was the central theme of most economists writing around Say's time. Put a different way, I believe that the early macro-econoimsts' work reflects the state of the discipline at that time; they had figured out there was this thing called an "economy" and were trying to learn about all it's various pieces. However, I do believe that Keynes was right in the implication many took from Say's overall works, which is that in creating an environment wherein supply is allowed to form and proliferate with as little interference as possible, demand naturally follows.

I mention the above debate to highlight the fact that in our present situation, we're already trying these ideas associated with supply side economics (or trying to increase supply) with no real success.

Corporate and personal taxes as a percent of GDP are already near 60 year lows. The theory of low taxation is that it will put more money in the pockets of consumers and businesses, who will in turn spend it. In addition, a low level of taxation is supposed to encourage the formation of businesses. These have had the desired result.

Non-financial corporate business is already swimming in cash. And

Corporate profits after tax are already near highs. In short, balance sheets have already increased. Finally,

Equipment and software investment (read, business investment) has already rebounded.

In short, supply side (read, Say's policies) are already in place. But Say's law of "supply creates its own demand" isn't working as advertised.

The reason it's not working is that monetary velocity is incredibly low:

The above charts tell us that people are hoarding cash rather than spending it.

Ultimately, what's going on here? The real answer is that in the middle of a debt deflation recovery, people hoard cash. The entire process is explained by Irving Fisher in his paper, "The Debt Deflation Theory of Great Depressions." However, here is the essence of his writing:

(1) Debt liquidation leads to distress setting and to (2) Contraction of deposit currency, as bank loans are paid off, and to a slowing down of velocity of circulation. This contraction of deposits and of their velocity, precipitated by distress selling, causes (3) A fall in the level of prices, in other words, a swelling of the dollar. Assuming, as above stated, that this fall of prices is not interfered with by reflation or otherwise, there must be (4) A still greater fall in the net worths of business, precipitating bankruptcies and (5) A like fall in profits, which in a " capitalistic," that is, a private-profit society, leads the concerns which are running at a loss to make (6) A reduction in output, in trade and in employment of labor. These losses, bankruptcies, and unemployment, lead to (7) Pessimism and loss of confidence, which in turn lead to (8) Hoarding and slowing down still more the velocity of circulation. The above eight changes cause (9) Complicated disturbances in the rates of interest, in particular, a fall in the nominal, or money, rates and a rise in the real, or commodity, rates of interest. Evidently debt and deflation go far toward explaining a great mass of phenomena in a very simple logical way.

Note that the economy is through the worst parts of the above cycle of events. However, now the economy is dealing with a slowing macro level environment from the EU and China, leading to concern and a "freezing" of activity.

The bottom line is that -- as Keynes correctly noted -- the policies outlined by adherents to Says law are ineffective in dealing with a period when employment of resources is below full potential.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 4350-4355). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 4337-4350). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 4336-4337). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Location 341). Classics-Unbound. Kindle Edition.

John Maynard Keynes (2011-01-20). THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY (UPDATED w/LINKED TOC) (Kindle Locations 334-341). Classics-Unbound. Kindle Edition.

Morning Market Analysis; Stalling Markets and the Fed

All of the ETFs that track the major averages have stalled at resistance: the IWMs have hit the 82 level and stopped; the QQQs are at 68.5 and the SPYs are at 142. We also see all major averages consolidating in some pattern: the IWMs and SPYs are forming a symmetrical triangle pattern while the QQQs are in the middle of rectangle consolidation pattern. In short, the upward momentum has stopped at important levels.

At the same time, we're seeing the treasury market rally in reaction the Bernanke's speech last week. The IEIs have retraced 100% of the end of July-middle of August sell-off, the IEFs have crossed the 61.8% Fib level and the TLTs are at the 61.8% level. This treasury rally will pull money away from the equity market making a move above current resistance very difficult.