Saturday, February 27, 2010

In Response to Mr. Scott's Rebuttal

First, he notes that I plotted a non-logarithmic chart of productivity growth instead of a logarithmic one, the implication being that a logarithmic chart would somehow arrive at a different conclusion. Of course, the first question a reader of Mr. Scott's article should ask is, "if this chart is so damning, why did Mr. Scott not include it is his article? Here, Mr. Scott is engaging in a standard legal defense tactic: when the data is against you, question it in some manner without showing proof. This is also a very popular tactic among right wing radio personalities, especially in regards to global warming data. The answer is clear: the chart in logarithmic scale and normal scale show the exact same situation: a chart that shows a clear expanssion of US manufacturing output. See this on page 5 of the complete PDF's from the Federal Reserve. Secondly, according to the Federal Reserve, growth in manufacturing output did not decrease after 2000 as Mr. Scott claims. According the the same source (the Federal Reserve's industrial production chart), manufacturing output increased from 2000 until the end of 2007. At the same time, manufacturing jobs dropped by about 5 million. This eviscerates the root of his argument.

Next, Mr. Scott notes that my co-blogger and I used a chart of manufactured imports and manufacturing jobs compared same to to demonstrate there is no relationship between the trade deficit and manufacturing employment. What Mr. Scott fails to recognize is this: if the US were replacing manufactured goods produced in the US with manufactured imports from other countries, there would be a relationship between imports of manufactured goods and manufacturing jobs. Yet as the US started to import more manufactured goods there were not a concomitant decrease in employment jobs. In addition, my co-blogger Silver Oz demonstrates this lack of causal relationship between the trade deficit and manufacturing in this article, titled, Free Trade Is Not the Job Killer.

Finally, while I am sure that Mr. Scott is a fine economist, it is patently obvious he engages little with real-world manufacturing executives. As a tax attorney, I am regularly consulted on the question of adding physical infrastructure to factories at the expense of employees. When asked these questions, I usually ask why. And the answer is always the same: "more output per unit of input." The classic John Henry story is playing out across all industries with remarkable alacrity. In fact, if you look at the change of physical infrastructure in manufacturing over the last 20 years, you will see the exact same pattern across all industries: an increase in equipment at the expense of employees.

In short, Mt. Scott has a preconceived view of the world (all trade is bad) and is attempting to fit the facts to his view. I would encourage him to broaden his horizons, leave his ivory tower and engage some business owners to see what they think. However, I would also encourage Mr. Scott to use the services of a third party in his interactions, as people skills are obviously not his strong suit.

Friday, February 26, 2010

Weekend Weimar and Beagle

Weekly Indicators: Sometimes the Bear eats you Edition

Sometimes you eat the bear. Sometimes the bear eats you. When it comes to struggling average Americans, this week the data showed the bear having a feast. The Conference Board's consumer confidence measure slipped a full 10 points, a very dramatic move, although at week's end that was not confirmed by a generally sideways move in the University of Michigan's consumer sentiment report. The reason may have to do with politics, specifically the Democratic party's collective pearl-clutching fainting spell after they were reduced to a 59-seat "minority" in the Senate:

"Consumers have been getting more impatient with the slow progress of the stimulus program, and confidence in the Obama administration's economic policies has begun to wane," Richard Curtin, director of the [Michigan] surveys, said in a statement.New and existing home sales both tanked, with new home sales setting a record low. Existing sales were essentially exactly where they were when they bottomed a year ago. Unlike "cash for clunkers", it appears that the $8000 home buyer credit did only pull demand forward. If so, however, we should expect a rebound in a few months as that plays out.

If that wasn't bad enough, initial jobless claims rose to 496,000, the highest weekly number in 3 months. The 4-week moving average also increased to 472,750, and that number cannot be explained by snowstorms several weeks ago. My best guess is that we are seeing municipal and state government layoffs, but we'll find out more about that in a week.

When you get away from American consumers and start talking about manufacturing, it's like you are in a different country. The Chicago PMI "posted a surprise increase from 61.5 in January to 62.6 in February." This reading is among the highest in the last 20 years, and confirms all of the other manufacturing reports out in the last several months. Strip away those pesky people, and industries are having a terrific recovery.

For another example, here is a graph of the American Trucking Association's index for January, which was reported this week:

The graph shows that trucking loads have increased 2/3's of the way from their recession bottom to their pre-recession top, and are now virtually equal to where they were in January 2007, the last January before the recession began. The American Trucking Association noted that this "gain boosted the SA index ... to ... its highest level since September 2008."

One leading Doomer at Daily Kos was sure that the GDP report for 4Q 2009 would be revised, and he was right - just not in the direction he thought: it was revised upward 0.2% to 5.9% annualized. If this revision holds up, we only need Q1 2010 GDP to be +0.5% for YoY GDP to be 2.0%, and if Q1 2010 GDP is +2.5%, the YoY GDP will also be +2.5%, which strongly supports at least some job growth.

Turning to the high-frequency weekly numbers, the ICSC same store retail sales for the week ending February 20 increased 4 0% YoY and 2.3% WoW. Similarly, ShopperTrak "reported that year-over-year GAFO retail sales increased 6.2 percent for the week ending Feb. 20 while sales rose 4.4 percent versus the previous week ending Feb. 13," saying:

Sales reached a seasonal peak as Valentine’s and President’s Day spending spurred shopping early in the week providing both a year-over-year and week-over-week boost. Additionally, ShopperTrak reported GAFO sales levels increased last week as the Eastern markets recovered from blizzard like conditions and consumers dug out to visit various retail locations and spend.This week, at least, points to a better real retail sales report for February, but we will see in a few weeks.

If truck traffic was increasing briskly, rail traffic was more mixed, as cyclical, intermodal, and total traffic remained up year over year, but cyclical traffic declined compared with last week. Baseline traffic is again below where it was a year ago, a real conundrum.

Gasoline demand last week was up from a year ago, the first YoY increase this year. Prices at the pump increased to $2.66/gallon. Oil on Friday was just below $80/barrel.

The Daily Treasury Statement for February 24, 2010 showed $129.7B in withholding taxes paid this month vs. $126.0 for the same date last year. February 2009 ended with $142.9B paid. We have two more days of reporting this year (vs. three last year), so the jury is out as to whether this month will show an actual YoY increase for the first time since a year into the Recession.

Finally, following my blog Tuesday, Tim Iacono of The Mess that Greenspan Made updated his CS-CPI graph, and here it is:

Will consumers drag down the economy, or will the economy pull up consumers? My bet is on the second: as several bloggers noted this week, developing economies, in particular in Asia, are leading the recovery. The average American consumer is no longer the locomotive, but the caboose.

P.S.: This week, this blog posted its 4,000th entry. Thanks to all who read and comment!

GDP Revised Higher

U.S. economic growth accelerated to the strongest pace in over six years late last year, with the Commerce Department Friday revising up its fourth-quarter estimate as businesses slowed inventory reduction and boosted spending, but consumers spent less than first thought.

Gross domestic product rose at a 5.9% annual rate October through September, the fastest rate since the third quarter of 2003, the Commerce Department reported. GDP expanded by 2.2% in the third quarter of 2009.A month ago, the department first estimated that GDP -- a measure of all goods and services produced in the economy -- rose by an annual 5.7% in the fourth quarter.

I'm sure the upward revision will be commented on by all the doom and gloomers .....

Free Trade Is Not A Job Killer

As we all know, the trade deficit has ballooned in recent decades as is evidenced by the following graph (all graphs are thumbnails due to the quantity in this piece):

We can clearly see that really beginning for good at the end of the 1991 recession the trade balance went down dramatically, with the only sustained recoveries occurring during recessions. So, let's look at how goods producing employees have been affected by this trade deficit by decade.

The trade deficit really got its start during the early 80's recessions when high interest rates by the Fed created a strong dollar really hurt exports causing their nominal dollar value to flat line from 1981 through 1986 before they took off again in 1987. The following graph shows goods employment vs. the trade deficit for the 80s:

This graph shows no link between the increasing trade deficit and goods employment in the 80s with goods employment rebounding even while the deficit grew following the end of the 81 recession.

Next up are the 90s; the decade of grunge, the stock market bubble, and NAFTA. One would expect to see massive declines in goods employment following the implementation of NAFTA and a ballooning trade deficit towards the end of the decade, but as you can see by the following graph the opposite actually occurred. Following goods jobs reaching their post-recession trough (the first jobless recovery) in late 1992, the exploded up 10% from that bottom at the same time that the trade deficit went from essentially -$18 billion to over -$90 billion.

Now let us move on to our most recent decade; where trade with China exploded, we endured two recessions (both with jobless recoveries), and an enormous increase in national debt. AS you can see from the following graph, the goods employment trough didn't occur until about 2 years after the first recession ended, which also coincided with a huge increase in the trade deficit, yet once again goods jobs held their own during the massive trade imbalance.

Then, during the most recent recession, goods jobs dropped like a rock (down nearly 20% from the pre-recession peak) and yet the trade deficit actually decreased (and yes, oil was a part of this, but it has also been a big part of our trade deficit all along.

So then, what does can account for our decline in goods employment over recent years, especially over the last decade where it really dropped off a cliff? The most simple answer seems to be that our productivity has reached a point where it can outstrip production demands, which leads to a decline in the labor intensity needed for goods production.

Let's examine this a bit further. From the end of the 1990 recession to the pre-2001 recession peaks productivity was up about 47%, industrial production was up about 61%, and goods employment was up about 9.3% (I used the end of 1990 recession value and not the trough in actual goods employment here). So during the 90s, production outstripped productivity (although both were up a ton), while job creation came in at only +9.3%, obviously lagging. However, from their 2001 recession troughs (again using the end of the recession for jobs), productivity was up about 25%, industrial production was up about 15%, and jobs declined by about 4.3%. This graph demonstrates that when productivity outstrips production goods jobs decline, but that even when production outstrips productivity job growth can be anemic so long as the productivity growth is still substantial. The current recession is showcasing productivity's effects on jobs very well, as while production has dropped about 13% during this recession, productivity is actually up over 5%, and industrial production is now at it's 2002 levels, but with roughly 20% fewer workers making those goods.

In conclusion, the data appear to show that the real factor in goods job creation (or loss) is the relationship between productivity and production, which unfortunately leaves little room for protectionism (even sans the trade war implications that would create), as unless productivity falls precipitously we would see no net job creation from any such endeavor.

And just so we don't define this as a US problem, I will direct you to a conference board study that highlights China's loss of manufacturing jobs to productivity too.

More on Initial Unemployment Claims

A.) From the late Spring to the end of last winter, we've seen initial unemployment claims drop from 650,000 to 450,000. The drop was consistent.

B.) Since that time, we've seen initial unemployment claims bounce between 450,000 and 500,000.

Since the beginning of the year we've seen two periods when there were distortions in the data. The first was about a month ago. The second was this report, which Bloomberg noted:

The number of jobless filing for initial unemployment claims increased in February, pointing to trouble for the February employment report and sending equities and commodities lower in immediate reaction. Initial claims jumped to 496,000 in the Feb. 20 week, the highest level since November. The four-week average, up 6,000 to 473,750, is also the highest since November and is more than 15,000 higher than January levels. In an ominous note for the monthly jobs report, claims offices said heavy weather increased the number of claims in the week. Continuing claims, where data lags by a week, were slightly higher at 4.617 million and are little changed from January levels. The unemployment rate for insured workers is unchanged at 3.5 percent.

Initial jobless claims unexpected jumped a sizeable 31,000 to 473,000 in the week ended February 13 week after dropping 41,000 the prior week. There are important special factors possibly affecting the data but the Labor Department offered no explanation. An obvious probable factor was extremely heavy weather through most of the nation in the reporting week, and results from four states had to be estimated including the key states of Texas and California with holiday backlog in the latter having skewed prior reports. Count on lots of speculation on how snow storms over the past two weeks affected the numbers.

I'm not sure how much credence I give to that statement regarding weather. For example, I live in Houston, Texas, where the winter has been really cold by Texas standards. We've even had snowfall in Northern Texas cities like Dallas. For a city that is not equipped to deal with this (no snow removal, inability to deal with driving on ice etc...) it can be a big problem. But I'm just not sure I buy the argument that the weather is the reason for the skewed data. I'm not saying it's impossible, but not possible.

I think there are some fundamental factors at work here which, if they continue for more than a few (say, through March), will have some negative implications for the recovery.

Forex Fridays

Today's Market

The same analysis applies to the SPYs and the QQQQs

A.) Note that prices are floating around the EMAs. Also note that prices are in a pennant formation. Finally, the EMA picture is fairly bullish -- all the EMAs are rising and the shorter EMAs are about to move over the longer EMAs.

B.) Momentum is increasing and

C.) Money is flowing into the market

A.) The transports printed a strong bar yesterday on the news of increased transportation sales in the durable goods report. Also note the bullish EMA picture -- the shorter EMAs are moving higher and the shorter EMAs have moved through the longer EMAs.

B.) Momentum is increasing and

C.) Money is flowing into the security.

B.)

Thursday, February 25, 2010

Welcome to Campaign for American's Future Readers

New Home Sales Drop

The Commerce Department said on Wednesday sales of newly built single-family homes dropped 11.2 percent to an annual rate of 309,000 units, the lowest level since records started in 1963, from 348,000 units in December.It was the third straight monthly drop and the largest percentage decline in a year. Analysts, who had expected a 360,000 unit pace, said bad weather was partly to blame and warned of more of the same for February.

"There is no doubt that January and February are going to be messy months for housing, given the severe weather conditions, but that does not take away from the fact that the housing sector has taken another big step back, even with government aid," said Jennifer Lee, a senior economist at BMO Capital Markets in Toronto.

Let's go to the data:

This look more like a continuation of the bottom forming in New Homes sales. I described the situation like this a few weeks ago:

The pace of new home sales is still at the bottom. It rebounded a bit, but in reality the best way to describe the current pace of new home sales is "bumping along the bottom."

This is in line with new home construction whose chart is similar.

Jobless claims, Durable goods show worrying bifurcation

This morning Initial Jobless claims were reported at 496,000, the highest in nearly 3 months. The 4 week moving average increased to 473,750.

Up until now, the jobless claims data had not broken the downward trendline since March 2009. They have now done so. Add this to the surprise strong drop in the Conference Board's consumer confidence number (not confirmed at this point by the similar, older U of Michigan survey), and you have a worrying setback on the jobs and consumer front.

On the other hand, durable goods orders were reported up 3% this month, and last month's report was revised up to +1.9%. While ex-transportation there was a -0.6% decline, last month's data ex-transportation was also revised up to +2.0%. Nondefense capital goods were up 4.7%. This completely turned around YoY Capital goods readings to a positive reading over 10%!

Besides the durable goods data, all of the regional Fed reports - New York, Philadelphia, and Chicago - have also come in strong. Industrial production came in good. The American Trucking Association's report for January showed a very strong increase -- to the point where trucking is back about 2/3 of the way from its recession bottom to its pre-recession top. All of these show a very strong manufacturing rebound that is continuing.

Bonddad and I have both suggested that exports and manufacturing may lead the way in this recovery, and both of us have noted that the US consumer, formerly the locomotive of the world economy, is now the caboose.

We are seeing - at least in one month's data - an amplification of that bifurcated pattern. The economy ex-people is having a V-shaped recovery, while the consumer - especially those in the bottom half of the income distribution - may not be seeing any improvement at all.

Reading Comprehension 101

A widening gap between data and reality is distorting the government’s picture of the country’s economic health, overstating growth and productivity in ways that could affect the political debate on issues like trade, wages and job creation.The shortcomings of the data-gathering system came through loud and clear here Friday and Saturday at a first-of-its-kind gathering of economists from academia and government determined to come up with a more accurate statistical picture.

This is proof -- IMHO -- of how rigged the data is.

Except for one point -- also contained in the article and usually not quoted:

The statistical distortions can be significant. At worst, the gross domestic product would have risen at only a 3.3 percent annual rate in the third quarter instead of the 3.5 percent actually reported, according to some experts at the conference. The same gap applies to productivity. And the spread is growing as imports do.

The very worst that would happen with the data is a .2% alteration in the GDP number -- and that is assuming the worst possible outcome.

This is the Ann Coulter school of footnotes -- the article sort of says what I want it to say, so I'll cite it as a source and hope no one notices.

People notice. This argument is an epic fail. Try again.

Thursday Oil Market Round-Up

In general, the oil market is still in a channel, between lines A and B.

A.) Prices are consolidating above the 61.8% Fibonacci level. In addition,

B.) Note the EMA picture. The 10 and 20 day EMA are rising. The 10 day EMA has moved through the 50 day EMA and the 20 is about to do so. All three shorter EMAs are rising.

Today's Market

A.) Prices are consolidating between the 50% and 61.8% Fibonacci level.

A.) Also note the price/EMA picture. Prices are consolidating on top of the EMAs. The shorter EMAs are moving higher, although at a smaller angle. However,

Notice the overall position of the microcaps. Instead of falling to the EMA for technical support, they are holding steady, as are

The Transports.

Wednesday, February 24, 2010

Consumer Confidence Drops

The consumer's mood is definitely downbeat, a strong indication that the jobs market isn't improving. The Conference Board's consumer confidence index fell back in a surprising and sizable way, down nearly 10 points to 46.0 in February (January revised to 56.5). Expectations, the index's leading component, fell more than 13 points to 63.8 reflecting a sweeping sentiment downturn in income, employment, and business conditions. The expectations index never really got going last year, barely approaching the watershed 80 level, a level consistent in the past with economic expansion.

The trouble in expectations signaled trouble for the present-situation component which dipped into the teens and toward the record lows of the early 80s. The index fell nearly 6 points to 19.4, reflecting pessimism over current business conditions where only 6.2 percent of the 3,000-home initial sample describe them as good. Only a miniscule 3.6 percent describe jobs as currently plentiful with 47.7 percent, up 1.2 percentage points from January, describing them as hard to get. This latter reading, which gets a lot of attention, will raise talk of trouble for February's jobs report.

Let's take a look at the data:

Note that after bottoming, confidence rose to the 55-60 level, and has stayed there for the better part of a year. The main issue here is jobs. While the employment picture is improving (job losses are near 0), we're not seeing the type of job gains associated with an expansion. In addition, there are certain segments of the employment market that have taken it on the chin in this recession (think manufacturing and construction and lower educated employees). As a result, there is reason to be concerned certain segments of the jobs market won't be coming back (which they probably aren't). And that has people concerned for good reason.

Case Shiller Mixed

On the good side, while the pace of year over year declines is still negative the rate of year over year decline continues to improve.

However, on a month to month basis we're seeing price appreciation stall, as evidenced by

However, on a month to month basis we're seeing price appreciation stall, as evidenced by

the fact a majority of cities have seen a decline over the last two months.

So -- what does this mean? Starting in November there was confusion in the market about the new home buyer tax credit program. As it was set to expire, we saw a big drop in existing home sales on a seasonally adjusted basis. Weaker demand = lower prices. We'll have to see how all of this plays out over the next few months.

Wednesday Commodities Round-Up

The DBBs appear to be in a classic up(A), down (B) and up (C) pattern which prices just broke at point D. Also note the lack of volume on the stretch C -- the volume is much lower than we would like to have on a rally.

A.) Prices rose to the 50% Fibonacci area, but couldn't keep the momentum going any more. Also note

B.) The EMA picture. In a true rally, prices maintain their momentum above the EMAs. Yesterday -- after they had risen through the EMAs -- prices fell back, printing a strong negative bar on increased volume. Also note prices moved through all three EMAs - a bad technical development.

Tuesday, February 23, 2010

Today's Market

A.) The drop in consumer confidence hit stocks hard after the open.

B.) Prices hit upside resistance from the EMAs

C.) After nearing the 38.2% Fibonacci level, prices retreated.

No, Virginia, US Manufacturing Isn't Dead

There is a common theme across the internet: US manufacturing is dead and it's never coming back. Well, there's a big problem with that analysis: it's not true. In fact, as the chart above indicates, it's actually false. Note that since 1960, the index of industrial production has risen from a little below 30 to its current level of about 100. And note the increase is continual -- meaning the number didn't just hover around 30 for most of that time only to spike up in one big move. The index has continually risen over that entire period.

Instead, what people are commenting on is the drop in manufacturing employment. Consider these two charts.

Durable Goods Employment remained fairly steady at 10 million to 11.5 million employees between the mid-1960s to the early 2000s. Then total employment dropped like a stone, losing three million people over the last 10 years. These are levels last seen in 1950.

Non-durable goods manufacturing is even worse. From the mid-1960s to the early 200s, total employment in this area hovered around a 6.8 million. However, starting in 2000, the number fell off a cliff, losing almost 2 million people. This is the lowest the number has been in over 60 years.

However, over the last 15 years we've seen an increase in manufacturing productivity. Consider the following:

Manufacturing Output per hour has increased continually since records have been kept, as has

Multi-factor productivity.

What does all this information tell us?

US Manufacturing is alive and well. The real issue is manufacturing employment, which is dropping like a stone. And the reason for the drop is an increase in productivity.

In addition, SilverOz adds the following:

Many people have a knee-jerk reaction to the decline in manufacturing jobs and immediately blame outsourcing/imports for this decline. The following graph demonstrates that the linkage between increased imports and a decline in manufacturing jobs is virtually nonexistent.

What we clearly see is that imports increased quite dramatically over the last 30 years, while good producing jobs remained fairly level (dipping during recession and then recovering) until this last recession, which took a huge toll on manufacturing employment even though imports actually declined. This again plays much better to the argument that productivity increases are the greatest contributor to our decline in manufacturing employment than the outsourcing/imports argument.

Case-Schiller CPI turns positive

The Case-Schiller house price index was reported this morning at -3.1% YoY for the month of January. This is the mildest decline in several years. This report, together with last Friday's inflation report, which showed a decline in core inflation due in part to "owner's equivalent rent," is cause for looking at an obscure but in my opinion crucial metric.

One of the most interesting alternate measures of the economy was first presented a couple of years ago by Tim Iacono of The Mess that Greenspan Made. The CS-CPI is the consumer price index, with the Case Schiller house price index substituted for owner's equivalent rent. When he introduced this measure, Tim noted that owner's equivalent rent had "utterly failed" to catch the inflationary implications of the housing bubble, and specifically that the Fed would have felt far more compelled to act than they actually did, believing inflation at the time to be quiescent.

By replacing owner's equivalent rent with the Case Schiller housing index, the CS - CPI captures the relative strengths of inflation vs. the deflationary impact of the bursting of the housing bubble on the economy. Thus, while Tim treated it as just a curiosity, I believe the CS - CPI uniquely captures an important dynamic. When it went negative in 2008, that meant that the contractionary impact of the housing bust was overwhelming the rest of the economy. On the other hand, I always suspected that the "real" bottom in the economy might be when the CS-CPI bottomed, meaning that the deflationary pressure on all things bought or sold by average Americans, including houses, was beginning to ease.

I hadn't looked at this statistic since last September. At that time I calculated that in January 2009 the CS - CPI measured (-10.1%), but that by September, it had risen (-5.3%). Here's a the most recent graph I can find, updated part-way through 2009:

Last Friday's negative core CPI due in part to a negative Owner's Equivalent Rent made me curious about what the CS - CPI was showing now. And I was in for a surprise.

The CS - CPI has now turned positive. By December it was +1.2% and in January it was +1.8%.

Of course, that doesn't mean it couldn't turn negative again, especially once the $8000 home buyers' credit expires. But for now at least, the CS - CPI is showing, for the first time in nearly two years, that the forces of contraction are not overwhelming the rest of the economy.

Treasury Tuesdays

A.) At the start of the year, the IEFs rallied to the 50% Fibonacci level, but couldn't get above same. Since then, they have pulled back.

B.) Note the EMA picture is bearish. First, prices are below the 200 day EMA indicating we're in a bear market. Also notice the shorter EMAs are below the longer EMAs and that prices are below all the EMAs.

A.) The long end of the market is in the middle of a downward sloping channel.

B.) The EMA picture is negative. Prices are below all the EMAs, all the EMAs are negative and prices are below all the EMAs.

C.) Note the heavy resistance prices hit at the 50 day EMA; this was an incredibly strong area of resistance.

Monday, February 22, 2010

Today's Market

An In-Depth Look At the Federal Budget

Let's start with a chart of government revenues and expenditures, starting in 1970:

The US has run a surplus 4 years since 1970, or about 10% of the time. Over those 39 years we've had Republican and Democratic control of both the White House and Congress. This leads to a very simple conclusion: no party can make a legitimate claim to being fiscally responsible.

Above is a chart of the total deficit for each year going back to 1970. First, note (again) only four years show a surplus. This means that for 35 years (and in fact for a longer period) the US has issued debt on a continuing basis to pay for its revenue shortfall. This means the US -- like most US corporations -- has to manage its Treasury operations. All this means is the US Treasury has to decide what maturity of Treasury bond to issue, how much of a particular Treasury bond to issue and when to issue it. Again, this is standard procedure from a corporate finance perspective.

Currently, total US debt is approximately $12.4 trillion and total US GDP is approximately $14.4 trillion. That makes the debt/GDP ratio 86%. While that is not good, it is not fatal.

Above is a chart of total federal outlays as a percent of GDP. Notice the number has been remarkably constant since 1970, fluctuating right around 20% for most of that time.

Let's take a look at the components of federal revenue.

Personal income taxes (the top blue line) comprise the largest percentage of federal tax receipts. In addition, these have continually comprised about 45%-50% of total federal receipts. The biggest change since 1970 has occurred in social insurance taxes (the yellow line), which have increased from a little over 20% to about 35%-40% over the last 10 years. Corporate taxes (the light purple line) have also been consistently responsible for about 10% of total tax receipts. Finally, note that estate and gift taxes (the light blue line at the bottom of the graph) overall contribution is more or less negligible on a percentage basis.

The above chart looks at federal receipts from a percent of GDP basis. Fist, note the percentages have been fairly consistent since 1970. Personal income taxes total between 8%-10% of GDP, corporate taxes total about 2% of GDP and estate and gift taxes account for less than 1% of GDP. The only big change has been an increase in social insurance taxes, which have increased to about 6% of GDP.

The above chart breaks federal spending down into mandatory, discretionary and interest payments. Mandatory spending has increased from a little under 40% of the federal budget in 1970 to right around 60% over the last few years. Discretionary spending has decreased from right around 60% in 1970 to a little under 40% over the last few years. The progression of mandatory spending is at the center of much of the budgetary concern in Washington and the public.

The above chart breaks federal spending down into mandatory, discretionary and interest payments. Mandatory spending has increased from a little under 40% of the federal budget in 1970 to right around 60% over the last few years. Discretionary spending has decreased from right around 60% in 1970 to a little under 40% over the last few years. The progression of mandatory spending is at the center of much of the budgetary concern in Washington and the public.Finally, note that interest payments are in fact pretty much under control. The primary reason for this is the near 20 year downward trajectory in interest rates:

Above is a chart of the 10-year CMT (constantly maturing treasury). Interest rates have been dropping for about 20 years. While there is considerable debate regarding the possibility of this continuing, we'll have to wait and see how that plays out.

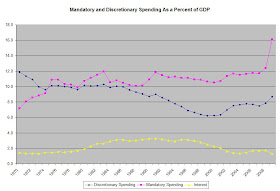

Above is a chart of mandatory and discretionary spending as a percent of GDP. Interestingly enough, despite the increase in the dollar amount of discretionary spending, it has remained more or less constant on a percent of GDP basis. The recent spike may be the result of the extraordinary budgetary circumstances the country is currently in. Additionally, discretionary spending actually dropped until the beginning of the decade when it started to rise again. Finally, interest payments are under control for now.

Finally, the chart above shows the percentages of SS, Medicaid and Medicare of mandatory spending. The big issue here is clear: note the increase of medicare as a percentage of mandatory spending. It's been increasing for some time.

So, what does all of this tell us about the US budget?

1.) The total federal debt/GDP ratio and interest rate payments (both on a percent to total expenditures and percent of GDP) are manageable at current levels. All of this has been aided by a two decade long decrease in interest rates. It's doubtful that will continue given the current pace of expenditures. Most importantly, given the current rate of spending and debt growth, changes will have to be made once we are out of the recession for sure. And that's where the real political problem lies.

2.) While mandatory spending has remained constant as a percent of GDP, it's increase to about 60% of the current federal budget is perhaps the biggest problem the US faces going forward. And as the percentage increase in medicare payments indicates, medical payments are a primary reason for the problems the country faces at the federal fiscal level.

3.) The argument that the US is taxed to death is wrong. On a percent of GDP basis the US is taxed at moderate rates.

4.) I'm surprised how unimportant estate and gift taxes are to the overall scheme of things. Even before the generous estate tax credit of the last few years (essentially exempting estates worth less than $3.5 million), estate and gift taxes are remarkably unimportant from a total revenues perspective. It's obvious they serve another purpose such as the theoretical prevention of dynastic wealth transfer.